Duolingo and the Strategy That’s Redefining Education

#118: The company that made learning addictive and turned engagement into exponential growth

Hi, Investor 👋🏼

I’m Jimmy, and welcome to another edition of The Strategy Stack.

Yes, you read that right.

The Strategy Stack.

Today, Alex invited me to join for a special collaborative post. And honestly, there couldn’t be a better crossover.

Few topics are as intertwined as strategy and finance: one defines how a company competes, the other measures how well that strategy compounds over time.

So today, we’re going to talk about a stock that perfectly connects those two worlds…

Duolingo ($DUOL), a company that turned learning into a game, engagement into a business model and fun into free cash flow.

1. The Problem:

For years, the online education market looked promising on paper.

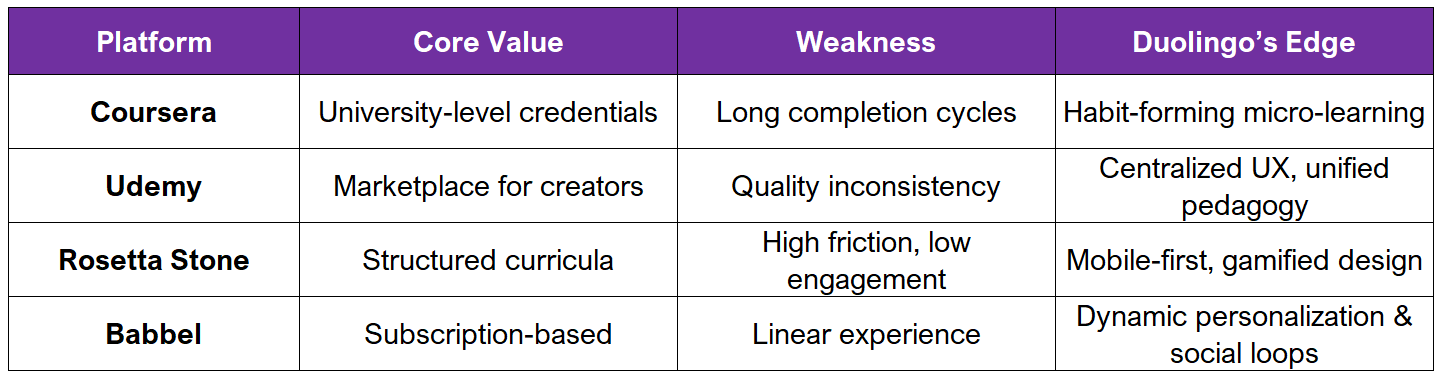

Coursera, Udemy, and edX gave anyone with Wi-Fi access to the world’s best courses.

Yet, the completion rate of MOOCs hovered below 10%.

The problem wasn’t content quality. It was human behavior.

Learning requires discipline, but digital learning removed the social pressure and accountability of physical classrooms.

Coursera optimized for credentials, Udemy for supply (anyone can teach), but few players optimized for engagement.

Learning was never the bottleneck. Motivation was.

That’s the gap Duolingo saw - and that’s the wedge it used to build a billion-dollar company.

2. Turning Learning into a Game:

Luis von Ahn and Severin Hacker didn’t start from pedagogy.

They started from psychology.

Their insight: people don’t return to learn. They return to win.

Duolingo’s core innovation wasn’t linguistic; it was behavioral design.

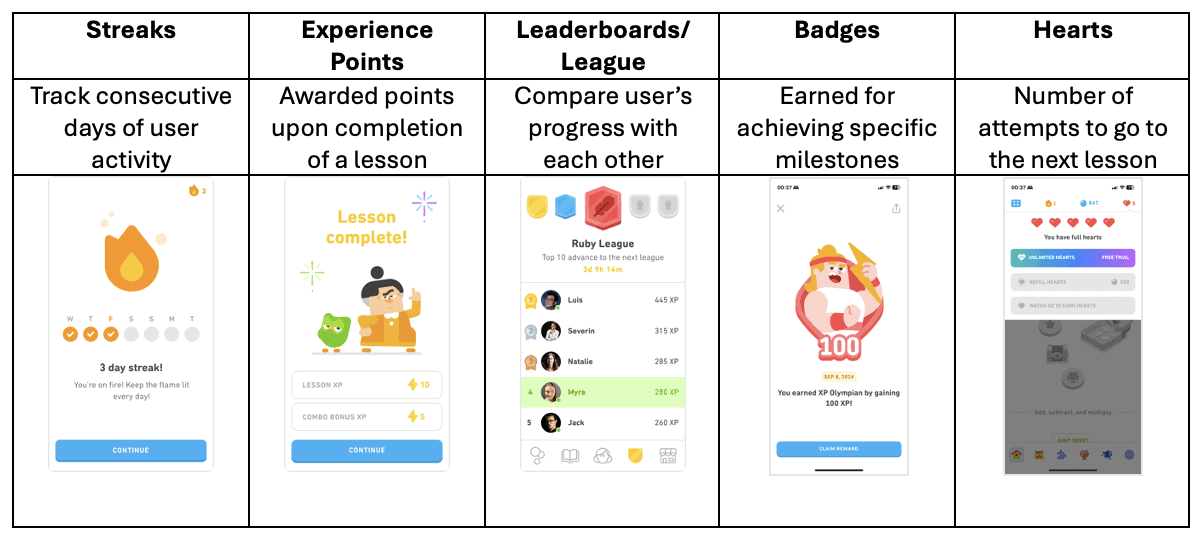

By borrowing from mobile gaming mechanics - streaks, leaderboards, rewards, and social competition - they built a product that triggers dopamine (not discipline).

Every completed lesson feeds a loop of positive reinforcement. Every missed streak sparks loss aversion.

Learning became habitual, not aspirational.

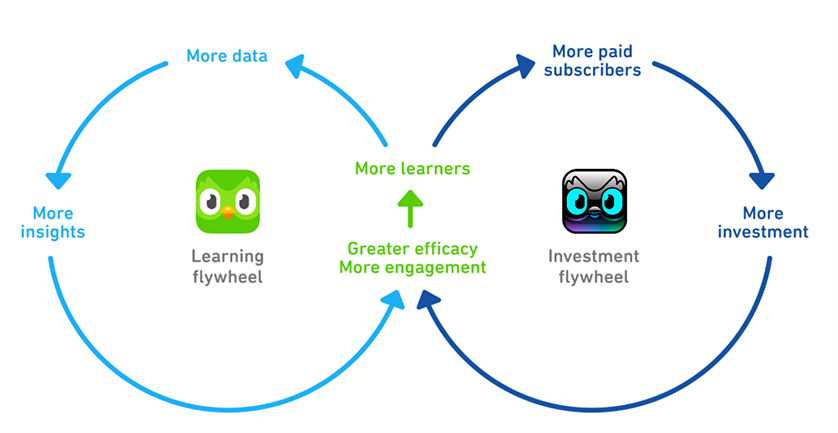

Gamification drives daily engagement.

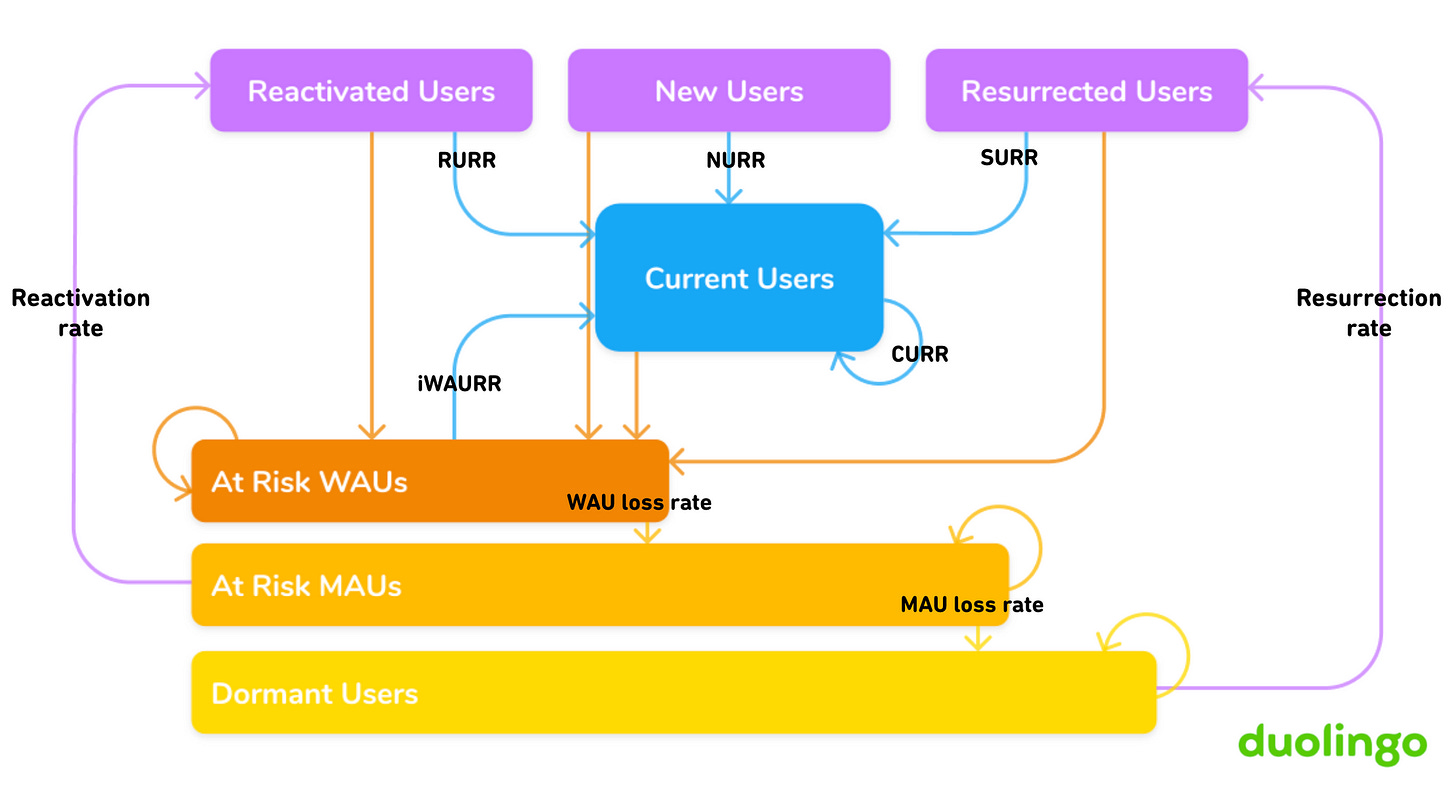

Engagement increases retention and data.

Data improves personalization and efficacy.

Better efficacy drives satisfaction (and organic growth).

A virtuous cycle of learning → data → engagement → monetization.

That’s not an app. That’s a flywheel.

3. Platform Economics:

Duolingo’s strategy looks playful, but it’s ruthlessly efficient.

The company runs hundreds of A/B tests every quarter, measuring how every sound, color, or notification affects retention curves.

It’s product-led growth at textbook scale: 90% of user acquisition is organic, powered by social-first marketing and virality (3 billion social impressions in 2023).

The freemium model acts as a massive funnel:

88 million MAUs experience the app for free.

8.3% convert into paid tiers (“Super” and “Max”).

90% of paid subs are annual or family plans > boosting LTV and cash flow visibility.

In finance terms: Duolingo optimized for unit economics of attention.

CAC: near zero.

Gross Margin: 90%+.

FCF Margin: 30% target by 2026.

That’s what happens when you turn what used to be a service (education) into a software product.

Low incremental costs, high scalability and a flywheel that compounds with every user.

4. Product Diferentiation:

Coursera and Udemy scale horizontally > by adding more courses.

Duolingo scales vertically > by increasing engagement depth per user.

That’s why Duolingo’s DAU/MAU ratio rose from 23% to 30% in three years - an unheard-of level in EdTech.

It’s the difference between offering education and engineering motivation.

5. The Financial Flywheel:

Underneath the playful interface lies a financial model worthy of any high-quality SaaS:

Top of Funnel: Freemium app > 88 M MAUs.

Conversion Engine: Gamified engagement drives 8% paid penetration.

Monetization: three levers:

subscriptions (72% revenue),

ads, and

the Duolingo English Test.

Operating Leverage: Minimal capex (< $15 M per year), FCF margin > 27%.

Each new learner improves the dataset that refines the AI model - which, in turn, makes future lessons more effective.

In capital markets language, Duolingo built a self-improving intangible asset.

And unlike most EdTech peers burning cash to acquire users, Duolingo grows organically, compounds engagement data and converts at increasing rates per cohort.

That’s incremental ROIC on digital learning.

6. Expanding the Frontier: AI, Math & Music

Duolingo’s next chapter blends education with AI - not just for personalization, but for teaching efficacy.

Its Duolingo Max tier, powered by GPT-4, introduces two premium features:

Explain My Answer: contextual feedback from an AI tutor;

Roleplay: simulated conversations with in-app characters.

Both increase perceived value and justify pricing power.

Beyond languages, Duolingo now teaches Math and Music, testing whether its engagement flywheel can scale to new domains of knowledge.

7. The Market’s View:

From a financial perspective, Duolingo is in rare territory:

+27% revenue CAGR (2023–26E)

88 M MAUs, 6.6 M paid subs, 30%+ DAU/MAU ratio

17.6% adj. EBITDA margin (2023), with target 30-35%

That efficiency is a direct consequence of strategic clarity.

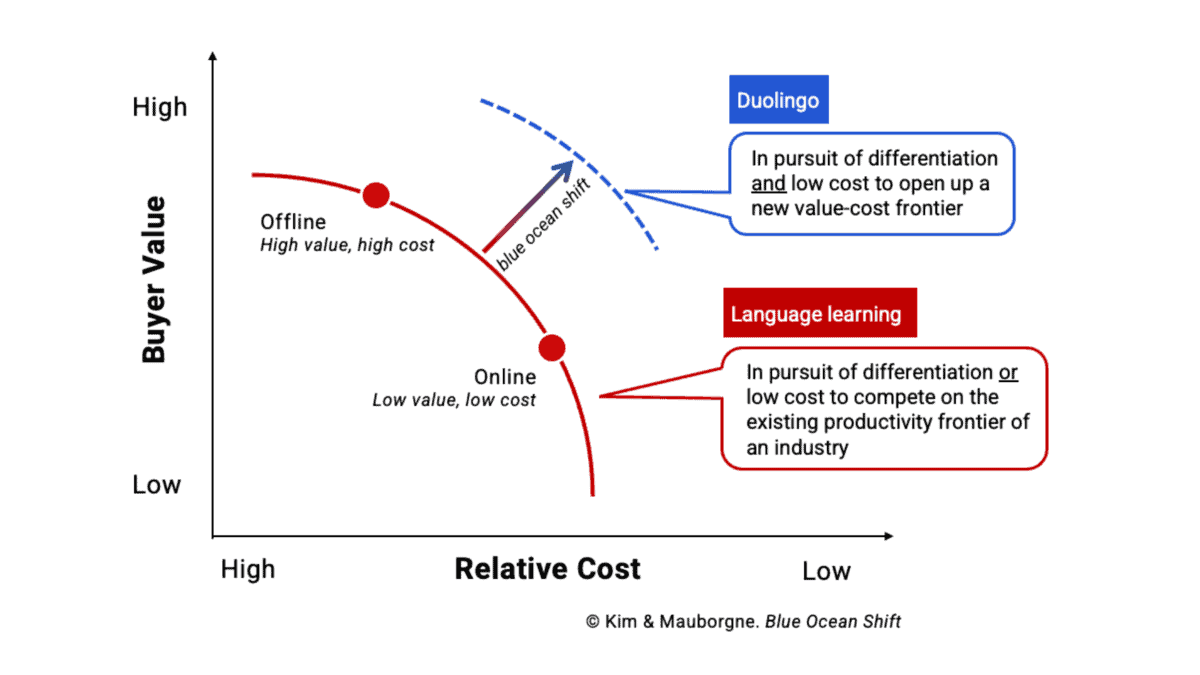

While most EdTech players fight over content libraries and B2B partnerships, Duolingo redefined the battlefield > moving from knowledge delivery to habit design.

It broke the classic education trade-off between cost and completion.

And in doing so, it expanded the productivity frontier of digital learning.

8. Strategy = Finance:

At Jimmy’s Journal, we often say: good strategy eventually shows up in the numbers.

Duolingo is proof.

Its product decisions - freemium funnel, gamified UX, social virality, AI feedback - translate directly into margins, retention and FCF generation.

You could model Duolingo’s business like any SaaS: recurring revenue, high contribution margins and low churn.

But what makes it special is the mission economics: making education universal by monetizing joy.

I hope you enjoyed the read so far.

Alex, thank you for the invitation. It was a pleasure contributing, and I hope this piece brought value to your audience.

At Jimmy’s Journal, we explore similar topics - but through a financial lens. How great strategies translate into long-term business performance and market value.

If that sounds like your kind of read, don’t forget to subscribe.

Cheers,

Jimmy

Hit subscribe to get it in your inbox. And if this spoke to you:

➡️ Forward this to a strategy peer who’s feeling the same shift. We’re building a smarter, tech-equipped strategy community—one layer at a time.

Let’s stack it up.

A. Pawlowski | The Strategy Stack

Thank you so much for the invitation, Alex! It was a pleasure to take part. I hope I was able to add value to your audience. Cheers!

Outstanding collaboration! The strategic finance crossover is spot on - Duolingo is one of the rare companies where product design and financial outcomes are inseperable. Your identification of motivation (not content) as the bottleneck perfectly frames why MOOCs failed while Duolingo scaled to 88M MAUs. The distinction between horizontal scaling (more courses) versus vertical scaling (deeper engagement per user) is crucial - DAU/MAU improving from 23% to 30% demonstrates compounding attention economics that most SaaS companies can't touch. The financialization of behavioral design is elegant: gamification drives retention → retention generates data → data improves personalization → personalization drives conversion. That's not just a flywheel, it's a self-improving asset with increasing marginal returns. Your point about minimal capex (<$15M/year) while achieving 27% FCF margins shows operating leverage that rivals pure software plays. The strategic clarity here is remarkable - Duolingo redefined the battlefield from credential delivery to habit formation, which fundamentally changes the competitive landscape. Looking forward to seeing how AI (Duolingo Max) continues to expand pricing power. Thanks for this insightful synthesis!