Evolution of Business Logic: Why Control Has Replaced Ownership

#145: The most valuable firms don’t own more — they coordinate better

For most of business history, scale meant accumulation.

More factories.

More inventory.

More people.

More capital.

Growth was linear because ownership was required.

And for a long time, that logic worked.

Until coordination became cheaper than control.

That’s when the rules changed.

The Shift Most Companies Misread

Many companies believe they’re competing in a digital economy.

But they’re still operating with industrial logic.

They optimize what they own.

They expand balance sheets.

They hire to grow.

They add assets to scale.

Meanwhile, the most valuable firms are doing the opposite.

They’re reducing the need to own anything at all.

Because modern advantage doesn’t come from production.

It comes from orchestration.

Why This Matters

Traditional businesses compete by accumulating assets.

Digital businesses compete by removing ownership from the equation.

As coordination costs approach zero, value shifts:

From production → to orchestration

From efficiency → to interaction

From owning resources → to enabling others

Firms that understand this transition design systems that scale without proportional capital, labor, or risk.

Those that don’t remain locked into diminishing returns.

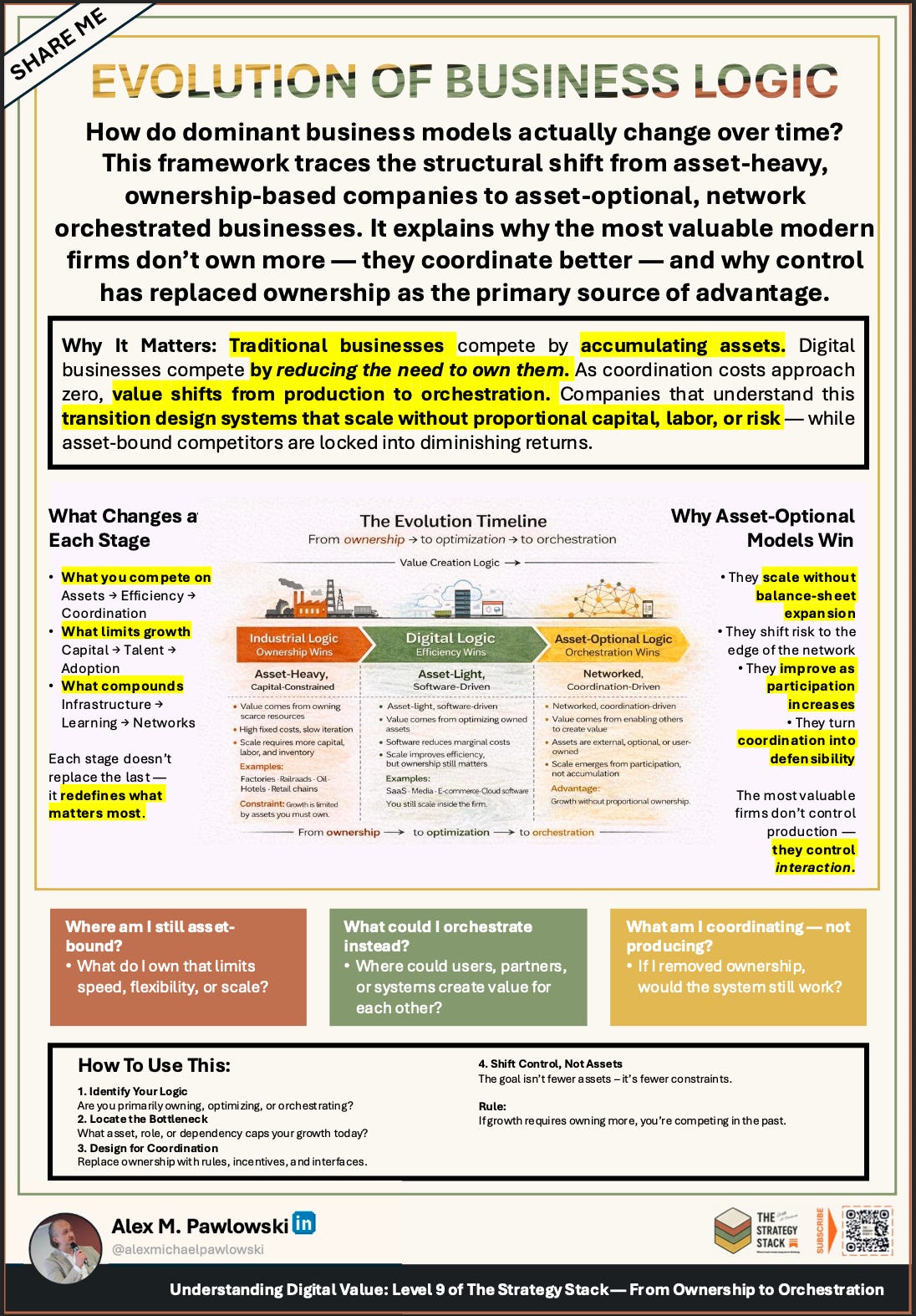

The Evolution of Business Logic

Business models evolve through three dominant logics.

Each one redefines what matters most.

1. Industrial Logic — Ownership Wins

In industrial systems:

Value comes from owning scarce resources

Scale requires capital, labor, and inventory

Fixed costs are high

Iteration is slow

Growth is constrained by what you can afford to own.

Examples:

Factories. Railroads. Oil. Retail chains.

Ownership is the advantage — and the bottleneck.

2. Digital Logic — Efficiency Wins

Digital firms reduce asset intensity:

Software replaces physical capital

Marginal costs fall

Efficiency improves

But ownership still matters

These businesses optimize what they own rather than eliminate ownership altogether.

Examples:

SaaS platforms. E-commerce. Digital media.

Growth is faster — but still bounded by internal optimization.

3. Asset-Optional Logic — Orchestration Wins

The most advanced models operate differently:

Assets are external

Risk is pushed to the edge of the network

Value is created by coordination

Scale comes from participation, not ownership

These firms don’t control production.

They control interaction.

Examples:

Marketplaces. Platforms. Networked ecosystems.

The system scales because others do the work.

What Actually Changes at Each Stage

The shift isn’t cosmetic.

Each stage redefines:

What you compete on

Assets → efficiency → coordination

What limits growth

Capital → adoption → governance

What compounds

Infrastructure → learning → networks

Each new logic doesn’t replace the last.

It reorders priorities.

And most firms fail because they optimize the wrong one.

Why Asset-Optional Models Win

Asset-optional systems behave differently:

They scale without balance-sheet expansion

They shift risk outward

They improve as participation increases

They turn coordination into defensibility

The most valuable modern firms don’t control production.

They control the rules of interaction.

That’s why copying them is so hard.

You can replicate features.

You can’t replicate a functioning network.

The Critical Question Most Leaders Avoid

Ask yourself:

Where am I still asset-bound?

What do I own that limits speed, flexibility, or scale?

Where could users, partners, or systems create value for each other?

If I removed ownership, would the system still work?

If growth requires owning more, you’re competing in the past.

How to Use This Framework

This cheat sheet is designed to expose outdated assumptions.

Use it like this:

1. Identify Your Logic

Are you primarily owning, optimizing, or orchestrating?

2. Locate the Bottleneck

Which asset, role, or dependency caps your growth today?

3. Design for Coordination

Replace ownership with rules, incentives, and interfaces.

4. Shift Control, Not Assets

The goal isn’t fewer assets — it’s fewer constraints.

The Real Insight

The most valuable firms don’t win by producing more.

They win by making production optional.

They design systems where others create value — and the firm coordinates it.

That’s how scale escapes gravity.

That’s how risk is redistributed.

And that’s why control has replaced ownership as the primary source of advantage.

Why This Layer Exists in The Strategy Stack

Most strategy frameworks still assume ownership is the goal.

This one forces you to question that assumption.

Because once coordination becomes cheap, accumulation becomes a liability.

And firms that understand that transition don’t just grow faster.

They grow differently.

👉 Unlock the Strategy Stack

…and access the Business Model Series, advanced Cheat Sheets, the S-Vault, and various essays at the intersection of strategy and technology.

Hit subscribe to get it in your inbox. And if this spoke to you:

➡️ Forward this to a strategy peer who’s feeling the same shift. We’re building a smarter, tech-equipped strategy community—one layer at a time.

Let’s stack it up.

A. Pawlowski | The Strategy Stack

Really enjoyed this. Clear, well-structured, and made me think differently about the shift happening. Thanks for putting it together.