How Did We Go from Owning Everything to Orchestrating Anything?

#89: 1.2 — How Did We Shift from Industrial Logic to Digital Economies?

Business models don’t evolve in a vacuum — they evolve with the logic of their era.

From the factories of the industrial age to cloud-native AI ecosystems, each technological wave has redefined how we create and capture value. What we’re witnessing now is not just a new business model, but a new operating logic — one that fuses digital transformation, AI strategy, and ecosystem orchestration into a single adaptive framework.

From Industrial Logic to Digital Strategy

Throughout history, business model evolution has followed the dominant sources of leverage:

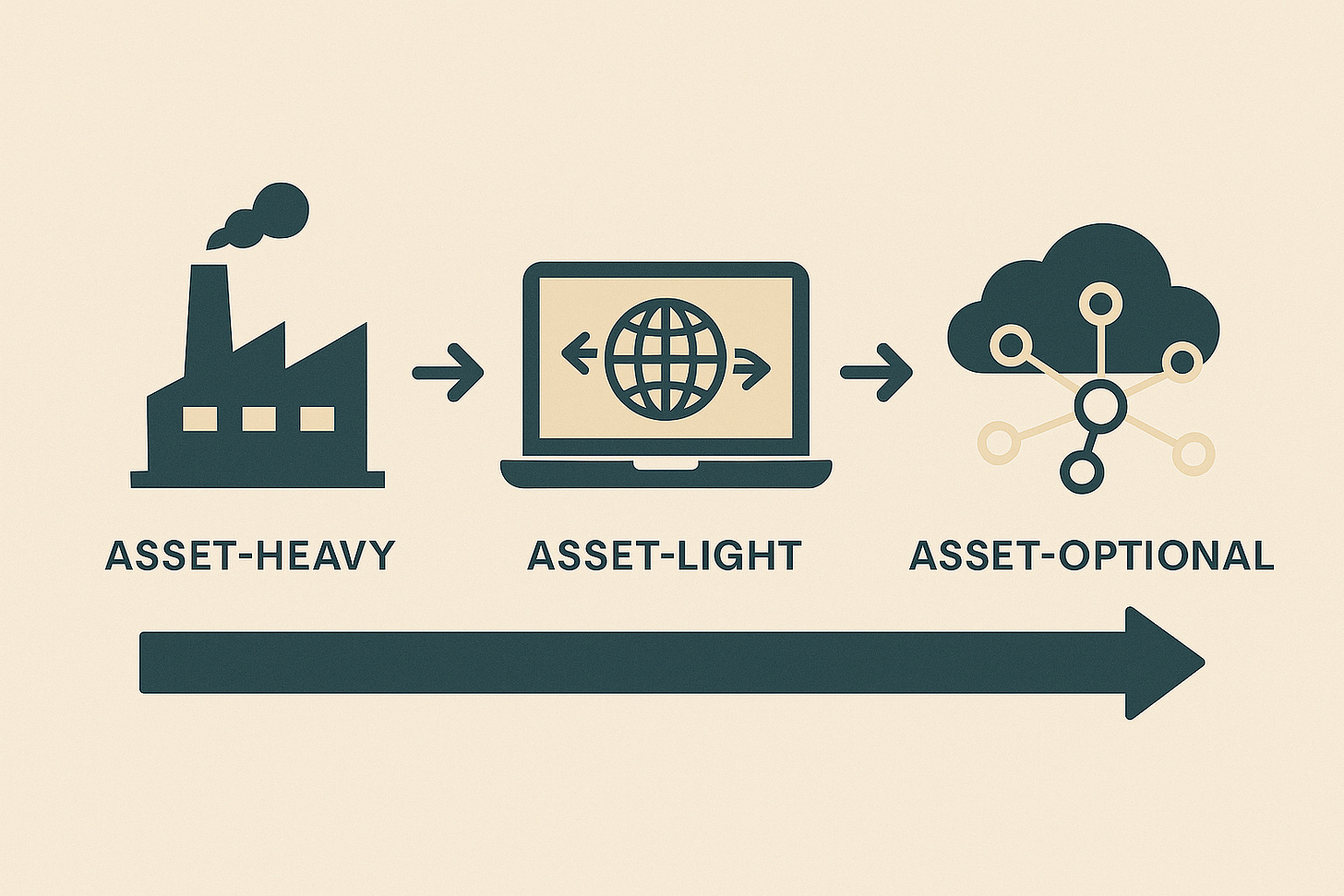

Asset-Heavy Models (Industrial Era): Control meant ownership — of factories, fleets, and infrastructure.

Asset-Light Models (Digital Era): Advantage shifted to owning demand, brand, and data.

Asset-Optional Models (AI-Driven Era): Power now comes from orchestrating ecosystems, APIs, and networks — not owning them.

This marks a fundamental pivot from control to coordination — the essence of digital strategy in 2025.

TL;DR — From Ownership to Orchestration: The Evolution of Business Models

Business models evolve through three historical phases:

Asset-Heavy (1900–1980s): Firms owned their entire value chain—factories, fleets, and retail networks.

Asset-Light (1990s–2010s): Competitive edge came from owning demand and brand, while outsourcing production.

Asset-Optional (2015–Present): Companies dynamically own, rent, or orchestrate assets through ecosystems, APIs, and partnerships.

Today’s leaders like Amazon, Airbnb, and Tesla combine all three approaches, strategically choosing when to own vs. orchestrate.

Modern ecosystems are recursive systems, where data loops continuously inform product design, distribution, and monetization in real time.

Key shift:

Yesterday’s moat: Physical asset ownership.

Today’s moat: Ecosystem orchestration.

Tomorrow’s moat: Adaptive, intelligence-driven systems that scale through data, AI, and embedded networks.

Table of Contents

Introduction: From Industrial Logic to Digital Economies

Phase 1: Asset-Heavy — Owning the Whole Value Chain

Definition & Characteristics

Advantages & Drawbacks

Classic Examples: Ford, AT&T, Coca-Cola

Phase 2: Asset-Light — Owning Demand, Not Supply

Definition & Characteristics

Advantages & Drawbacks

Examples: Nike, Apple, Booking.com

Phase 3: Asset-Optional — Orchestrating Ecosystems

Definition & Characteristics

Advantages & Drawbacks

Examples: Airbnb, Amazon, Tesla

From Linear Chains to Recursive Systems

Heatmap: Mapping Phases to Modern Business Model Layers

Asset-Heavy → Infrastructure dominance

Asset-Light → Distribution & Monetization

Asset-Optional → Intelligence & adaptive orchestration

Strategic Questions for Leaders

Key Takeaway: The Future of Competitive Moats

Phase 1: Asset-Heavy — Owning the Whole Value Chain

Era: ~1900–1980s

Logic: The industrial age defined scale through ownership.

Definition

In an asset-heavy model, firms controlled every layer of production and distribution — from steel mills to storefronts. Value was physical, not digital.

Advantages

Full control over supply chain and product quality

Tangible entry barriers through capital and scale

Drawbacks

High fixed costs

Low adaptability to demand shifts

Real-World Examples

Ford Motor Company: Vertical integration from steel to dealerships.

AT&T: Monopolized physical phone lines and equipment.

Coca-Cola: Early bottling networks were company-owned before franchising took hold.

Strategic Insight

This model optimized for stability, not agility — the inverse of today’s adaptive business models.

Phase 2: Asset-Light — Owning Demand, Not Supply

Era: ~1990s–2010s

Logic: The digital revolution made distribution and brand the true moats.

Definition

The asset-light model kept intellectual property and customer relationships in-house while outsourcing production and logistics.

Advantages

Fast scalability without proportional cost

Global reach through partnerships and platforms

Drawbacks

Reliance on third-party execution

Reduced control over customer experience

Real-World Examples

Nike: Owns brand and design, not factories.

Apple: Mastered product experience while outsourcing manufacturing.

Booking.com: Dominates travel without owning hotels.

Strategic Insight

This was the first digital inflection — a platform strategy where value accrued to those who controlled demand, not supply.

Keep reading with a 7-day free trial

Subscribe to The Strategy Stack to keep reading this post and get 7 days of free access to the full post archives.