Revenue Architecture: How the Top Digital Businesses of 2025 Capture Value and Scale Growth

#110: Chapter 4: Value Capture and Monetization Design / 4.1 Revenue Architecture, Not Just Pricing Models

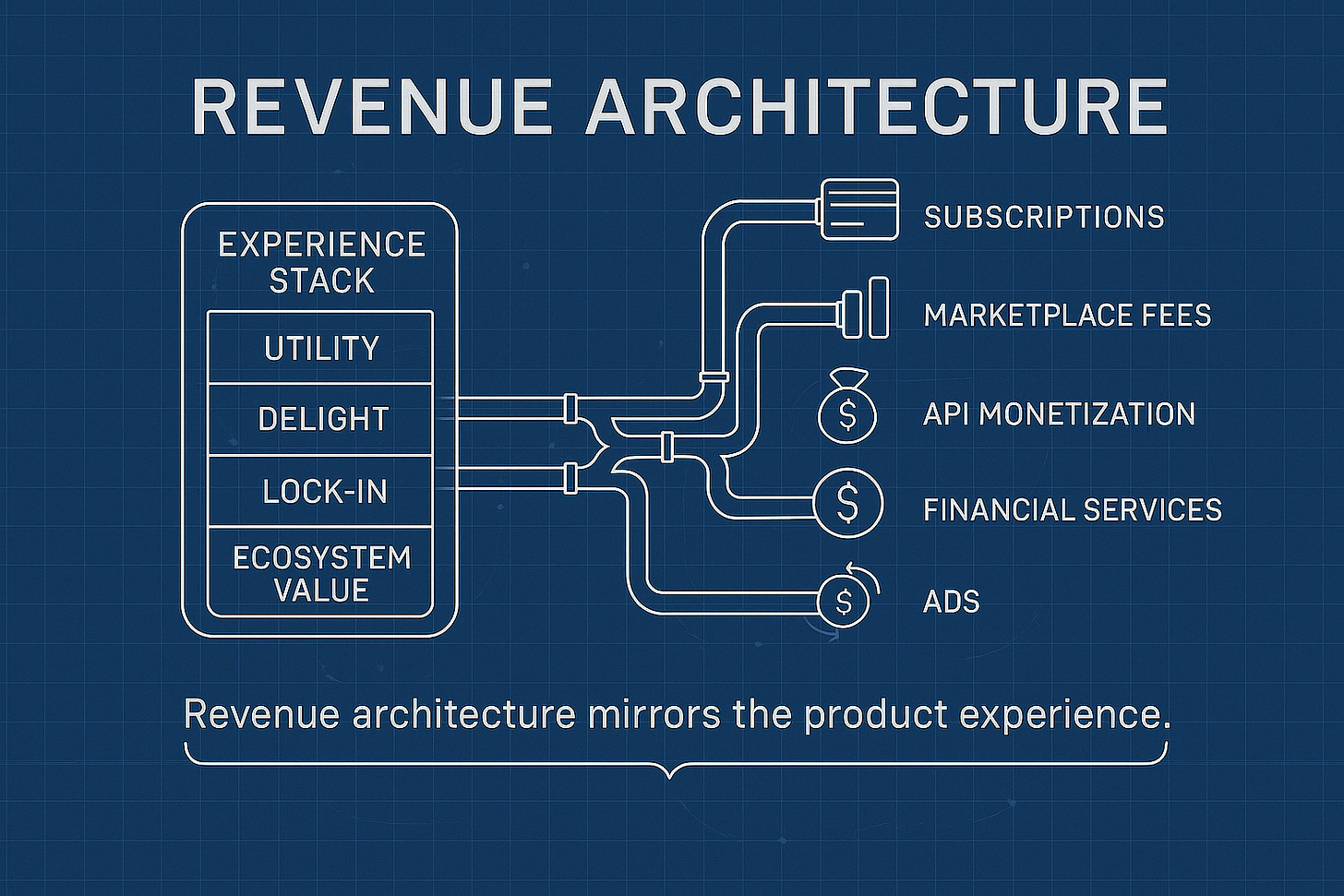

In Chapter 3, we explored how to create value: first through the Experience Stack (Utility, Delight, Lock-In, Ecosystem Value), then through Value Multipliers like data exhaust, feedback loops, and automation.

But a hard truth lurks beneath even the most brilliant product design: value creation alone is not enough.

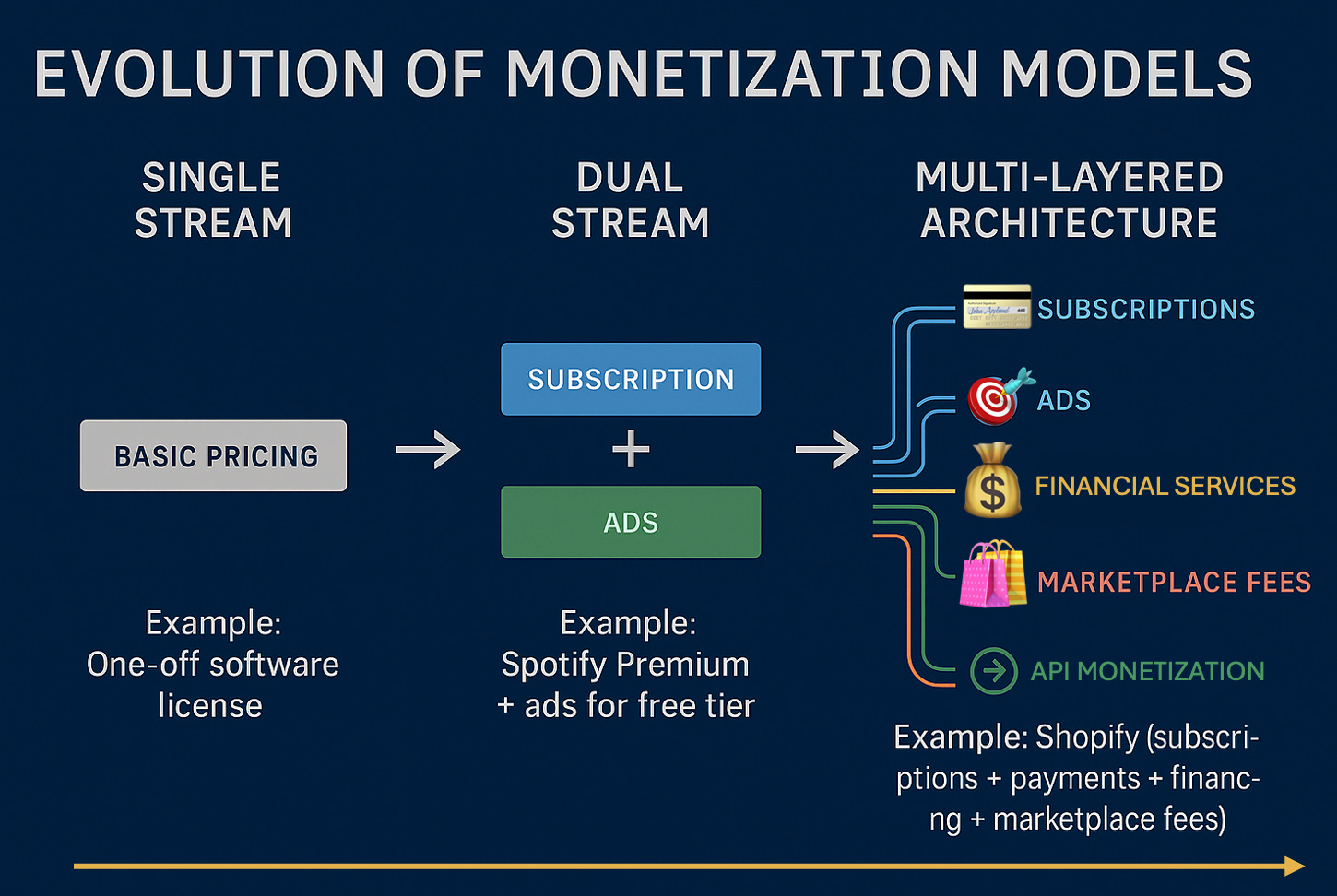

To build a sustainable digital business, you must also capture that value — turning engagement, data, and network effects into actual revenue streams. This is where many companies stumble. They think of monetization as a late-stage bolt-on, typically in the form of a single pricing model: subscriptions, ads, or transaction fees.

But the most successful firms of 2025 don’t rely on one stream.

Instead, they design Revenue Architectures: multi-layered systems that map directly to the modularity of their business models. These architectures are not just about how much you charge, but how value flows through the entire ecosystem.

TL;DR: Revenue Architecture, Not Just Pricing Models

Value creation alone doesn’t sustain a business — companies must capture value through multi-layered monetization systems.

Traditional pricing models are too narrow. Instead, design a Revenue Architecture that mirrors your product’s Experience Stack.

Four core revenue streams drive resilience: Subscription, Transactional, Attention-Based, and Embedded Finance/Affiliation.

Combining these streams creates revenue flywheels, as shown by Shopify and Duolingo case studies.

Key metrics like Revenue Concentration Risk and Attach Rate reveal system health and scalability.

AI-driven ecosystems of 2025 demand monetization strategies that are modular, ethical, and aligned with both users and partners.

Table of Contents

Introduction: From Value Creation to Value Capture

The Limits of Traditional Pricing Models

What is Revenue Architecture?

The Four Core Revenue Streams

Subscription

Transactional

Attention-Based

Embedded Finance & Affiliation

Case Study: Shopify’s Layered Revenue Architecture

Aligning Monetization with the Experience Stack

Essential Metrics for Multi-Stream Monetization

Best Practices for Designing Revenue Architectures

Case Study: Duolingo’s Multi-Stream Evolution

Strategic Implications for 2025 and Beyond

Closing Thought: Building Resilient Monetization Systems

References

The Limits of Traditional Pricing Models in Digital Business

Traditional strategy teams start with a pricing question:

“Should we charge per seat, per month, or per transaction?”

While important, this is like asking about roof shingles before you’ve designed the house.

Pricing is the surface layer. Underneath, there are structural choices that determine which pricing models even make sense.

Example:

Netflix circa 2010 could only succeed with a subscription model because its content costs were fixed and usage was unlimited.

Airbnb thrives on transaction fees because supply is variable and demand is episodic.

Shopify layers subscriptions and transaction fees, because it monetizes both merchants and the flow of commerce through its platform.

A pricing model is a tactical decision.

A Revenue Architecture is a strategic design.

What is Revenue Architecture? Key Components Explained

A revenue architecture maps four key elements:

Value Flows — Where is value being created and exchanged across the ecosystem? (e.g., merchants, buyers, partners, advertisers)

Capture Points — Where can you introduce monetization without breaking the experience? (e.g., checkout, API calls, premium features)

Monetization Mechanisms — The actual tools: subscriptions, usage-based pricing, ads, financial services, affiliate fees.

Layer Interactions — How different streams reinforce each other rather than compete for the same dollar.

Think of it as a financial twin of your Experience Stack.

Each layer of Utility, Delight, Lock-In, and Ecosystem Value should have a corresponding way to capture value — without undermining user trust or growth dynamics.

The Four Core Revenue Streams Every Digital Business Needs

Most digital businesses in 2025 combine several of these core archetypes:

1. Subscription (SaaS, Membership, Retainers)

Recurring fees for access to software, services, or content.

Strengths: Predictable revenue, strong LTV/CAC ratios, aligns with Lock-In.

Risks: Churn sensitivity, customer fatigue, high initial acquisition costs.

Examples: Figma, Notion, Duolingo Plus.

2. Transactional (Marketplaces, Payments, Usage-Based APIs)

Monetization triggered by a discrete action or sale.

Strengths: Scales naturally with ecosystem growth, lower friction for entry.

Risks: Revenue tied to external volume; vulnerable to seasonality.

Examples: Airbnb, Shopify, Stripe.

3. Attention-Based (Advertising, Sponsorships, Data Licensing)

Revenue tied to user attention and data signals.

Strengths: Unlocks free-tier growth, monetizes casual users.

Risks: Can erode Delight if intrusive, privacy regulation risk.

Examples: TikTok, YouTube, Spotify free tier.

4. Embedded Finance & Affiliation

Capturing value by sitting inside the financial flows of others.

Strengths: Extremely high margins, creates deep Lock-In for business customers.

Risks: Regulatory complexity, operational liability.

Examples: Shopify Capital, Uber debit cards, affiliate referral programs.

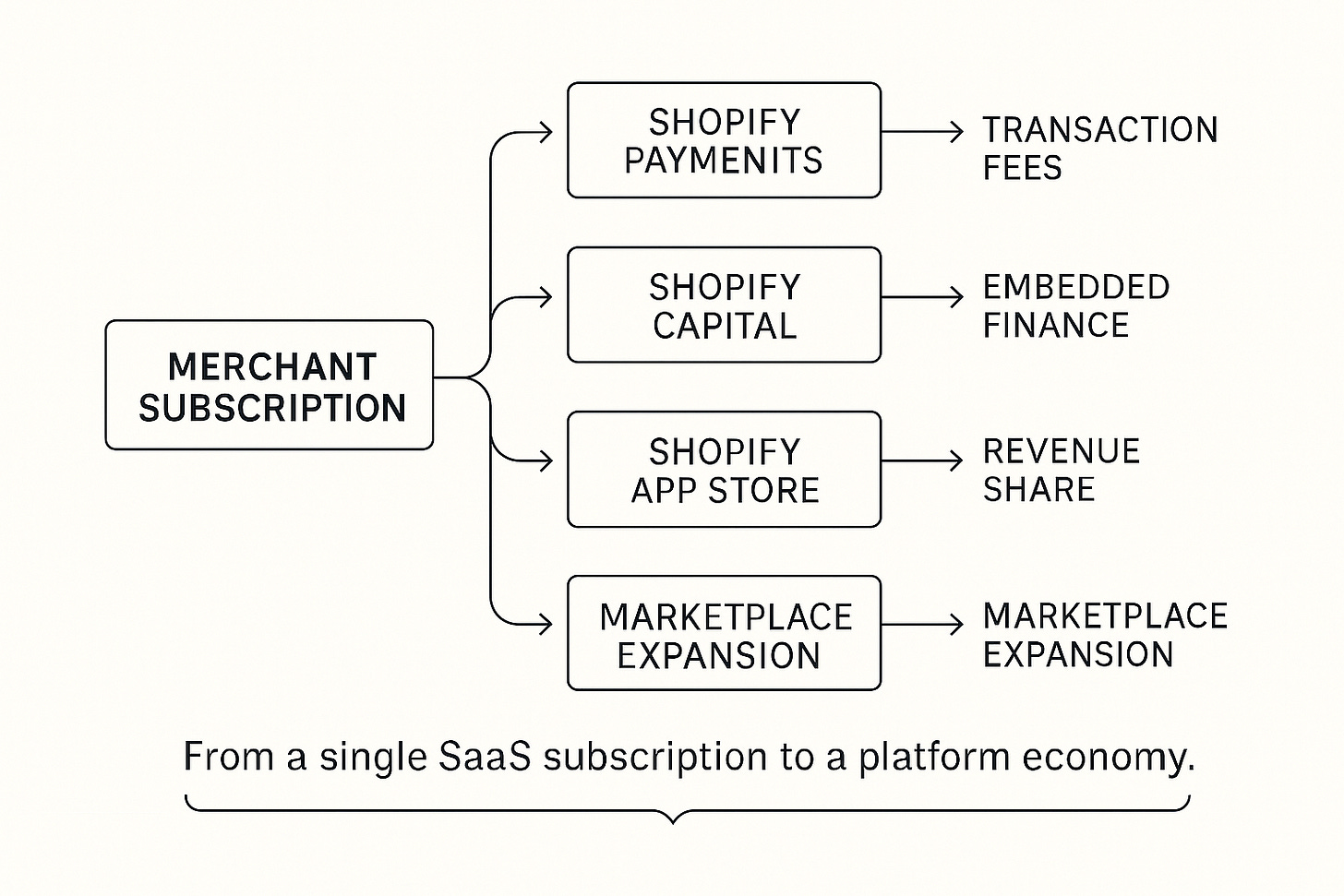

Case Study: Shopify’s Layered Revenue Architecture

The true magic happens when you combine streams so that they amplify each other rather than cannibalize.

Consider Shopify:

Subscription fees create a predictable base of merchants.

Transaction fees grow as those merchants succeed, aligning incentives.

Financial services (Shopify Capital, payments) deepen Lock-In by embedding Shopify into merchants’ cash flows.

App marketplace revenue extends the ecosystem, incentivizing partners to build.

This is a revenue flywheel: each stream accelerates the others.

By contrast, a company relying on a single stream has no such resilience.

Keep reading with a 7-day free trial

Subscribe to The Strategy Stack to keep reading this post and get 7 days of free access to the full post archives.