This Week in Tech: AI Accelerates, But Friction Grows

This week, U.S. courts handed Big Tech a major legal tailwind, affirming that publicly available web content can be used for AI training under fair use—fueling innovation, but deepening rifts with creators. The Big Beautiful Bill passed without its proposed 10-year AI moratorium, preserving states’ rights to regulate AI—marking a pivotal shift toward decentralized AI governance and a significant setback for Big Tech’s push for federal uniformity. Google and Meta doubled down: Google rolled out AI voice upgrades and genomic tools, while Meta launched a $14B AI lab with mega-compensation packages in a talent arms race.

On the chip front, Nvidia’s bullish outlook and strong Blackwell chip demand drove price target hikes, lifting AMD, Arm, and Broadcom along with it. Meanwhile, Microsoft announced over 9,000 layoffs—part of a growing tech sector trend that saw nearly 48,000 U.S. jobs cut in June alone, the worst quarter for tech jobs since 2020.

Markets surged to record highs, driven by AI and healthcare bets, but cracks emerged in the content ecosystem. Google’s AI Overviews led to a plunge in organic news traffic, with ChatGPT referrals rising but not enough to close the gap—raising questions about sustainability for publishers in the AI era.

Venture capital tilted toward scale over seed. Mega-rounds dominated, with Applied Intuition raising $600M and Pano AI pulling in $44M to fight wildfires. Sequoia led investor activity; Meta topped corporate spending, signaling AI’s pull on both sides of the table.

Globally, AI governance entered a new chapter. The U.S. Senate moved to allow state-level AI rules, challenging Big Tech’s preference for federal uniformity. India launched TGDeX to host AI-ready datasets, while India-EU and India-France deals aimed to deepen cross-border AI alignment. And in Washington, the DOJ’s new antitrust chief walked a tightrope—promising tougher enforcement without stifling innovation.

The signal is clear: AI is economic muscle, legal battleground, and geopolitical lever. And while momentum is strong, the friction is only just beginning.

Here’s the full breakdown:

🔮 AI & Big Tech

The Big Beautiful Bill passed without its proposed 10-year AI moratorium, preserving states’ rights to regulate AI—marking a pivotal shift toward decentralized AI governance and a significant setback for Big Tech’s push for federal uniformity.

Implications for tech:

⚖️ Regulatory patchwork ahead: Tech firms now face a complex web of state-level AI laws, increasing compliance burdens.

🛡️ More consumer protections: States can enact laws on deepfakes, biometric privacy, and child safety—faster than federal efforts.

🧭 Policy lobbying shifts: Big Tech must now engage more heavily with state legislatures, not just Washington.

🚫 Federal preemption failed: Industry hopes for a unified national AI framework were effectively dashed.

U.S. courts issued decisive rulings favoring Anthropic, OpenAI, Google, Meta, and others—ruling that publicly available online content may be used for AI training under fair use, significantly boosting legal protections for AI firms while creating concern among creators

Google’s June AI updates included expanded voice‑search capabilities in AI Mode, easier sharing of AI NotebookLM notebooks, and new research tools for genomic analysis

On the hardware front, Nvidia’s second‑half 2025 outlook improved and analysts raised price targets (e.g. from $170 to $185), citing strong demand for its Blackwell chip line; similar optimisms also lifted AMD, Arm, Broadcom, among others

Meta launched “Meta Superintelligence Labs,” committing over $14 billion to scale AI, aggressively recruiting top talent with compensation packages up to $300 million over four years

🎤 Tech & Organizational Moves

Microsoft announced plans to lay off ~4 % of its workforce (~9,100 jobs), in part to fund its AI infrastructure investments; its King division (Candy Crush) will cut ~200 positions (~10 %).

Across the industry, layoffs remained substantial: June saw ~47,999 job cuts in the U.S., Q2 saw highest job‑cut quarter since 2020, with tech accounting for over 76,000 roles eliminated so far in 2025.

Key executive hires in June included new CEOs at Kaseya, BCM One, ClearScale, CompassMSP (transfers from Intuit, Bandwidth, NewRocket, Praecipio Consulting) and leadership shifts at Lumen, Databricks, Cynomi, including hires from Microsoft, Salesforce, SentinelOne.

📈 Market & Platform News

U.S. markets ended June at record highs: Nasdaq +26% since April, S&P 500 and Dow also hitting all‑time highs; analysts forecast S&P could reach ~6,500 by year-end, supported by AI and healthcare strength—though risks from inflation and geopolitical headwinds remain

Google’s AI Overviews feature drove a sharp increase in “zero‑click” searches, reducing organic traffic to news sites from over 2.3 billion mid‑2024 to under 1.7 billion by May 2025. ChatGPT-based referrals to news sites rose to ~25 million in 2025 but haven’t offset the loss.

💸 Venture Capital & Startups

June 2025 VC Snapshot: Southeast Asia raised ~$284.7 m across 10 deals—a modest MoM recovery but still ~37 % below June 2024. Late-stage rounds dominated (~70 %) while seed-stage remained low (~2 %).

Global mega‑rounds surged: 60 % of Q4’24 $86B funding total driven by $100M+ rounds; significant momentum behind AI and industrial automation unicorns.

In U.S. venture activity, Sequoia was the most active investor in June; Meta, meanwhile, topped capital deployed among corporates.

Applied Intuition closed a $600 m Series F round at a $15 b valuation, backed by Andreessen Horowitz, Fidelity, Kleiner Perkins, M12, Porsche, Franklin Templeton, and Qatar Investment Authority.

Pano AI, an AI-powered wildfire detection startup, raised $44 m in Series B led by Giant Ventures; monitors ~30 m acres and aids over 250 emergency agencies.

🌍 Geopolitics & Tech Power

A bipartisan majority in the U.S. Senate overwhelmingly voted (99–1) to remove a 10‑year federal moratorium prohibiting state AI regulation from President Trump’s “Big Beautiful Bill.” The move preserves states’ rights to regulate AI despite tech industry support for federal uniformity.

DOJ’s new antitrust chief Gail Slater signaled a balanced agenda: aggressive antitrust enforcement targeting Big Tech while streamlining merger reviews to ensure U.S. competitiveness—positioning American innovation as able to lead without centralization.

In India, the Telangana government launched TGDeX, a data‑exchange platform designed to host 2,000+ AI‑ready datasets over five years in partnership with local institutions and JICA. Meanwhile, India‑France and India‑EU AI initiatives aim to deepen cooperation on responsible AI models and tools.

Strategy leaders are fluent in vision. But when it comes to tying that vision to financial reality? Many plans crumble on contact with the P&L.

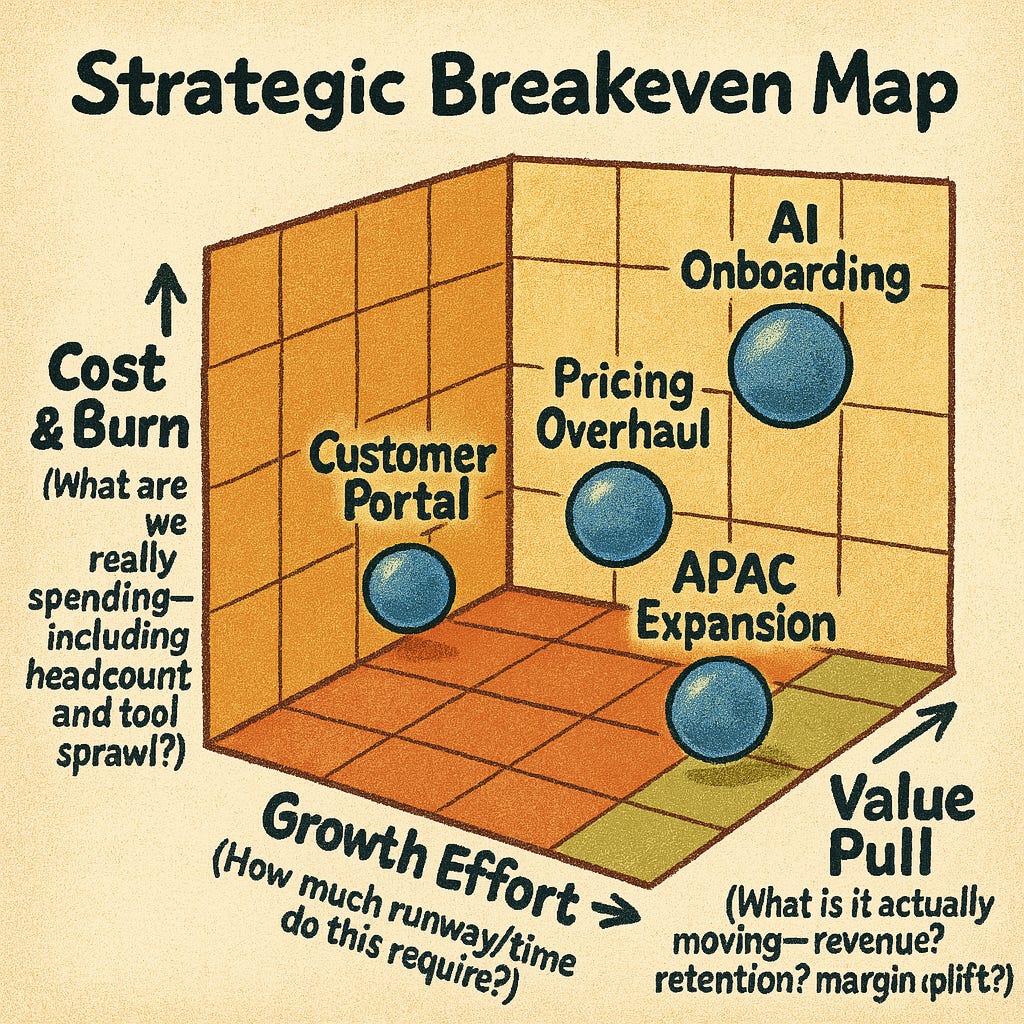

The Strategic Breakeven Map is built to fix that. It’s a simple but powerful tool for mapping the gap between:

Value delivered → vs. → Cost incurred

Growth story → vs. → Margin math

Ambition → vs. → Execution capacity

This week, we’re giving you a downloadable version to run your own breakeven test.

🗺️ What It Looks Like

Three axes. One map.

📈 Growth Effort (How much runway/time does this require?)

💰 Cost & Burn (What are we really spending—including headcount and tool sprawl?)

🧲 Value Pull (What is it actually moving—revenue? retention? margin uplift?)

Plot your major initiatives. Then ask:

👉 Which quadrant are we betting on the hardest?

👉 What’s the breakeven point—and how do we know we’re getting closer?

💡 Strategic Insight

Most orgs treat strategy as a portfolio of ideas. But the real leaders treat it as a portfolio of break-even paths. If a workstream doesn’t move the curve—fast or meaningfully—it’s noise, not investment.

Used well, this tool helps you:

✅ Kill orphaned initiatives with no economic arc

✅ Elevate bets with hidden upside

✅ Challenge where growth is subsidized by silent cost bloat

📩 What’s Next

📅 Coming Monday: “Leadership Signal Radar” — a fresh framework for spotting weak signals that matter, with a downloadable radar template, activation checklist, and real-world prompts.

🧠 We’ll explore how high-functioning orgs move from passively watching signals to actively shaping their response.

Hit subscribe to get it in your inbox. And if this spoke to you:

➡️ Forward this to a strategy peer who’s feeling the same shift. We’re building a smarter, tech-equipped strategy community—one layer at a time.

Let’s stack it up.

A. Pawlowski | The Strategy Stack