The Switching Cost Trap: Why Product-Led Growth Often Backfires

Why “Better” Products Lose to Switching Costs

Product-Led Growth (PLG) is the modern SaaS gospel: ship a slick UX, offer freemium tiers, hook users fast, and let the product sell itself.

It’s efficient, elegant — and often disastrously incomplete.

Because here’s the brutal truth: users don’t always switch to better products — not because they don’t want to, but because they can’t afford to.

Not financially. Cognitively. Organizationally. Behaviorally.

Welcome to the Switching Cost Trap.

The Myth of “Better Wins”

If you build a 10x better product, customers should stampede to your door.

In practice? That door stays eerily quiet.

Why? Because switching costs — both economic and behavioral — form invisible moats around incumbents. Unless your PLG strategy actively dismantles those moats, your growth engine stalls before takeoff.

Imagine you’ve built a sleek, modern CRM: effortless onboarding, deep integrations, and UI that makes Salesforce look like a museum exhibit.

Eighteen months and $2M in burn later, your mid-market pipeline is barely moving.

Here’s what your prospects see instead:

Data migration nightmares

Team retraining costs

Lost historical context

Rewritten SOPs and internal politics

The risk of being wrong

Even if your tool works better, your buyer must spend massive organizational energy to switch — and energy is the scarcest currency in enterprise.

McKinsey found that the average large company runs 129 SaaS apps. Switching just one ripples across the entire stack.

The Hidden Switching Costs

Let’s break them down:

1. Economic Switching Costs

Easy to model, hard to absorb.

Dual licensing, retraining, and migration downtime all add up.

Example: Snowflake vs. Oracle.

Snowflake’s cloud-native edge is undeniable, yet Oracle’s entrenched ecosystem keeps customers locked in. In 2023, Snowflake grew 36% YoY — but Oracle’s cloud business still grew 30%. Why? Switching inertia, not superiority.

2. Behavioral Switching Costs

This is the internal politics tax.

Even if your champion VP loves your product, they must spend internal capital convincing Finance, Ops, and IT to approve it.

That resistance compounds exponentially in regulated industries like finance or healthcare.

3. Psychological Lock-In

Humans crave familiarity.

Convincing a team to leave Slack, Jira, or Notion often triggers an instinctive “but this works fine” reflex — even when it clearly doesn’t.

That’s organizational inertia in action.

When PLG Meets Reality

Product-Led Growth assumes the product can sell itself. And it can — but only in low-friction markets.

In high-switching-cost categories like:

Enterprise SaaS

Fintech infrastructure

Healthtech

Deeply integrated APIs (Stripe, Twilio, Plaid)

…the product can’t sell itself until the switching friction is neutralized.

Rippling understood this.

They built a genuinely elegant HR and payroll platform — but their true innovation wasn’t just the product. It was white-glove implementation.

They knew the biggest barrier to adoption wasn’t features — it was fear of the switch.

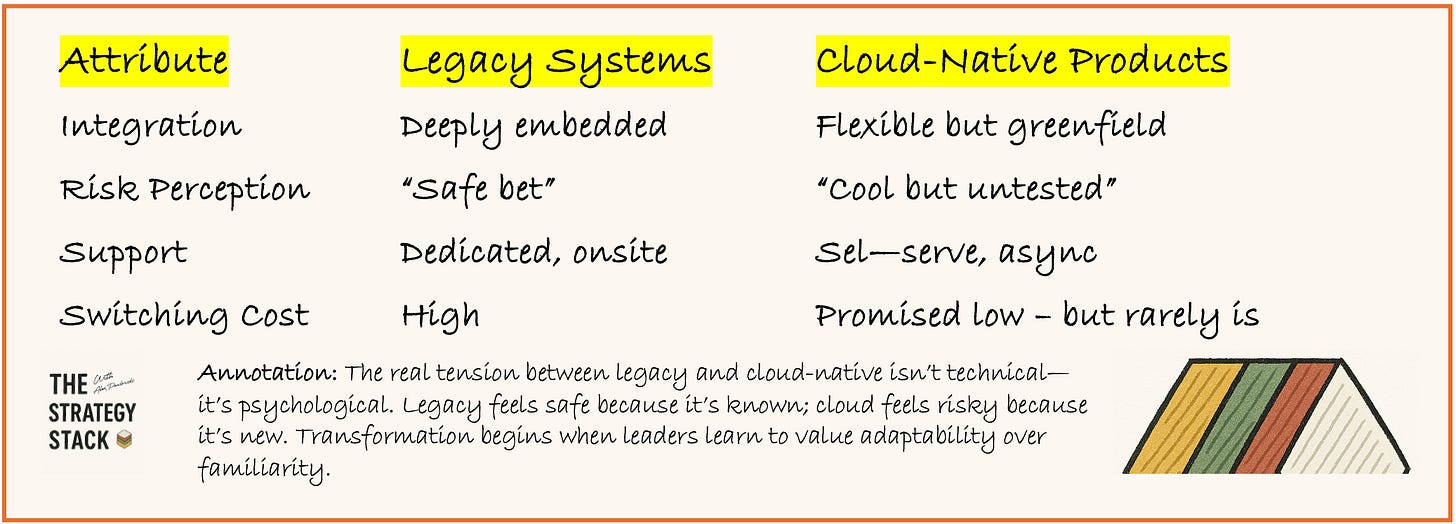

Cloud-Native vs. Legacy: Why “Better” Often Loses

Take Epic Systems in healthcare.

Clunky, dated UX. Yet over 35% U.S. hospital market share.

Why? The integration moat. Replacing Epic would mean rebuilding the hospital’s operational nervous system from scratch.

This is the reality most PLG startups underestimate: legacy wins not on merit, but on mass.

Quantifying the Trap

According to Gartner (2023):

77% of enterprises cite integration complexity as their main barrier to switching vendors

Only 19% complete SaaS transitions within 6 months

62% of failed PLG strategies underestimate switching costs

Translation: most “better products” lose because they don’t help customers switch.

How to Beat the Switching Cost Trap

Here’s what the smartest growth and product strategy teams do differently:

✅ Build a “Switching Kit”

Prebuilt migration scripts and sandbox environments

Data-mapping tools and timeline templates

Assisted onboarding baked into the PLG motion

✅ Reduce Decision Risk

Create ROI calculators and TCO benchmarks

Share side-by-side case studies from similar verticals

✅ Offer Hybrid Models

Enable customers to run both systems in parallel (“shadow adoption”)

Let users test real workflows before committing

✅ Win Internal Champions

Provide internal pitch decks, FAQs, and objection-handling guides

Equip advocates to “sell” your tool internally

✅ Monetize the Inertia

If you’re the incumbent?

Bundle features. Deepen integrations. Create an ecosystem gravity well — one that rewards staying rather than punishes leaving.

(Think Apple ecosystem, not airline fees.)

Final Takeaway: Play the Game You’re In

Product-Led Growth works — but only when switching costs are near zero.

In high-friction, mission-critical, or regulated spaces, your growth strategy must be dual-layered:

A product that sells itself.

A go-to-market motion that pulls customers through the switch.

The companies that win don’t just build better products —

They build better bridges between the old and the new.

Because in the end, the best growth strategy isn’t about being the prettiest product in the room.

It’s about being the easiest one to adopt.

Hit subscribe to get it in your inbox. And if this spoke to you:

➡️ Forward this to a strategy peer who’s feeling the same shift. We’re building a smarter, tech-equipped strategy community—one layer at a time.

About: Alex Michael Pawlowski is an advisor, investor and author who writes about topics around technology and international business.

For contact, collaboration or business inquiries please get in touch via lxpwsk1@gmail.com.

Source:

[1] McKinsey & Company. (2020). How software-as-a-service companies grow. Retrieved from https://www.mckinsey.com/industries/technology-media-and-telecommunications/our-insights/how-software-as-a-service-companies-grow

[2] Gartner. (2023). Market Guide for SaaS Management Platforms. Stamford, CT: Gartner Research. DOI unavailable; accessed via enterprise database.

[3] Gartner. (2022). Survey: Integration complexity remains top barrier to SaaS adoption. Retrieved from: https://www.gartner.com/en/newsroom/press-releases

[4] Snowflake Inc. (2023). Form 10-K Annual Report. U.S. Securities and Exchange Commission. Retrieved from: https://investors.snowflake.com/

[5] Oracle Corporation. (2023). Q4 FY2023 Earnings Report. Retrieved from: https://investor.oracle.com/

[6] Epic Systems Corporation. (2022). Market Share and U.S. Hospital Adoption Data. Cited via KLAS Research and HealthTech Magazine: https://healthtechmagazine.net/

[7] Harvard Business Review. (2011). The Hidden Traps in Decision Making. Hammond, J.S., Keeney, R.L., & Raiffa, H. Retrieved from: https://hbr.org/2006/01/the-hidden-traps-in-decision-making

[8] Parker Conrad (CEO, Rippling). (2022). Interview with TechCrunch Disrupt. Rippling’s approach to replacing legacy HR systems. Retrieved from: https://techcrunch.com/

[9] Redpoint Ventures. (2021). The Mechanics of Product-Led Growth. Retrieved from: https://redpoint.com/blog/product-led-growth

[10] Reforge. (2022). Why PLG Breaks in the Enterprise. Retrieved from: https://www.reforge.com/blog/why-plg-breaks-in-the-enterprise

[11] Apple Inc. (2022). Apple Ecosystem & Switching Costs Strategy. Analysis retrieved from: Dediu, H. (2022). “The Apple Advantage”, Asymco. https://www.asymco.com/