Tokenomics, Usage-Based Models, and Soft Paywalls: The Future of the Participation Economy

#114: 4.3 Tokenomics, Usage-Based Models, and “Soft Paywalls” Advanced techniques in frictionless capture and community-driven monetization

In 2025, the challenge isn’t how to design a monetization model — it’s how to make it fair, adaptive, and participatory.

Traditional systems — static subscriptions, blunt tiers, and rigid paywalls — no longer align with user expectations or platform dynamics.

Customers now expect to pay in proportion to what they consume, contribute, or create.

That’s why forward-thinking companies are building participation economies — dynamic systems where value creation, usage, and revenue are connected through token incentives, value-based pricing, and soft paywalls.

These mechanisms are transforming how digital platforms grow:

Tokenomics: Turning users into active stakeholders.

Usage-based and dynamic pricing models: Scaling value with real engagement.

Soft paywalls: Converting trust into revenue, not friction.

Together, they form a new platform monetization strategy — shifting from extraction to participation.

TL;DR: Monetization in 2025 = Participation Architecture

Modern monetization requires fairness, transparency, and shared benefit.

Tokenomics aligns incentives through ownership, rights, or governance.

Dynamic pricing models scale cost with real activity — not arbitrary tiers.

Soft paywalls replace “stop screens” with contextual engagement flows.

The result: monetization that feels fair, fluid, and community-driven.

Table of Contents

Introduction: Beyond Revenue Architecture — The Execution Challenge

The Strategic Shift in 2025

Tokenomics: Turning Incentives into Participation

Usage-Based Pricing: Aligning Cost with Value

Soft Paywalls: Frictionless Conversion

Case Study: Duolingo’s Hybrid Monetization Engine

The Strategic Frontier: Participation Architectures

Closing Thought: From Monetization Walls to Flows

References

Introduction: Beyond Revenue Architecture — The Execution Challenge

Most pricing innovation fails not because the idea is bad, but because the execution system doesn’t match user behavior.

The new generation of platform monetization strategies isn’t about adding complexity — it’s about designing systems that adapt dynamically as participation evolves.

The Strategic Shift in 2025

From fixed prices to fluid participation.

From static walls to dynamic pricing models.

From extraction to ecosystems.

This is the participation economy — where the line between user and contributor disappears, and monetization becomes a shared value loop.

Tokenomics: Turning Incentives into Participation

Tokenomics has matured beyond crypto hype. It’s now a tool for creating engagement-driven ecosystems that reward contribution and align growth with value creation.

Unlike loyalty points, token incentives carry real utility — from access rights to governance power — transforming users into co-owners of the system’s success.

Examples:

Reddit Community Points reward contributors with tokens used for governance and influence.

Helium incentivizes network growth through token rewards tied to real infrastructure usage.

Axie Infinity showed that speculative token models collapse when utility and demand aren’t balanced.

Best Practices for Tokenomics:

✅ Anchor tokens to tangible value — not speculation.

✅ Create circular economies where users reinvest rewards.

✅ Maintain scarcity and transparent governance.

✅ Ensure every token interaction supports platform health and fairness.

Strategic takeaway:

Tokenomics turns a business into an ecosystem of participation — the cornerstone of the modern participation economy.

Usage-Based & Dynamic Pricing Models: Aligning Cost with Value

Dynamic pricing models are redefining fairness.

They charge based on real activity and value delivered — not arbitrary plans.

Cloud, SaaS, and API-first companies have already proven the model:

AWS / Azure: Pay only for compute or storage used.

Snowflake: Scales pricing with query volume and data consumption.

Twilio: Built an empire on per-message pricing.

OpenAI: Charges per token — a literal example of token-based value metrics.

But with flexibility comes responsibility. Without clear feedback, bill shock erodes trust.

Best Practices for Dynamic & Usage-Based Pricing:

✅ Use real-time dashboards for cost visibility.

✅ Combine base subscriptions with dynamic tiers.

✅ Align pricing with outcomes, not just activity.

✅ Build fairness into every interaction.

Strategic takeaway:

Dynamic and value-based pricing transform monetization into a trust contract — customers pay in proportion to value received.

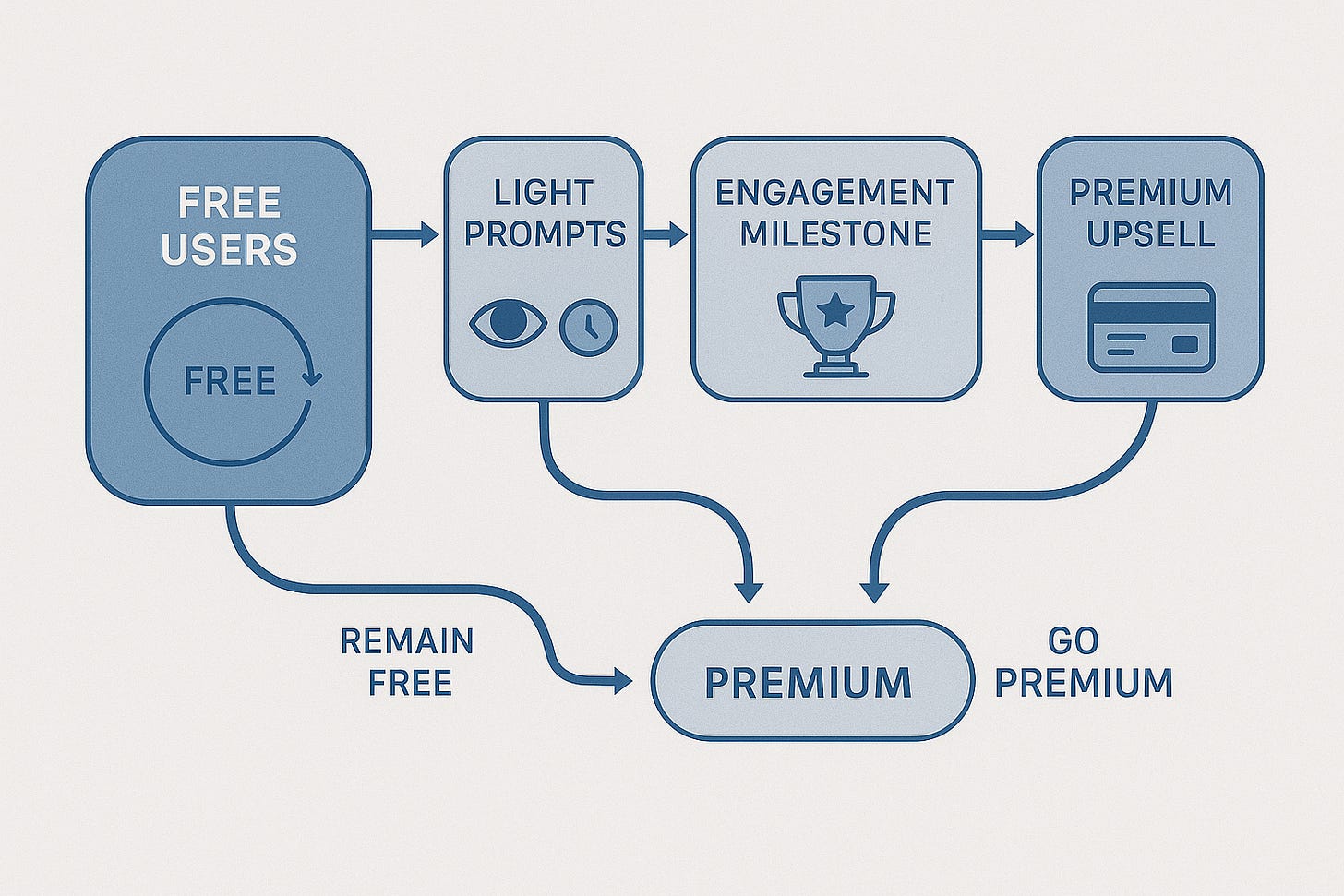

Soft Paywalls: Frictionless Conversion Without Losing Trust

Hard paywalls block access. Soft paywalls build relationships.

They let users experience value before asking for commitment — converting engagement into loyalty instead of interruption.

Examples:

The New York Times: Uses free-article limits and personalized nudges to drive upgrades.

Notion: Converts free-tier users naturally through usage thresholds.

Duolingo: Blends ads, freemium tiers, and certifications into a seamless experience.

Best Practices for Soft Paywalls:

✅ Calibrate thresholds for curiosity, not frustration.

✅ Trigger invitations contextually (milestones, streaks, progress).

✅ Use positive framing — “unlock more” instead of “you’ve hit a wall.”

✅ Never interrupt the user’s core value loop.

Strategic takeaway:

Soft paywalls convert engagement into trust — and trust into revenue.