What Does Modularity Mean for Digital Models in 2025?

#98: 2.3 — The Rise of Model Modularity - From Monolithic Playbooks to Composable Business Architectures

Chapter 2.2 mapped the taxonomy of digital business models. Now, Chapter 2.3 explains why those archetypes aren’t static—they’re now modular, orchestrated, and dynamic. In 2025, the leading firms don’t just choose a model—they compose one.

Modern digital businesses resemble microservices architectures, where revenue logic, distribution, AI, and monetization are interchangeable modules you orchestrate, not monolithic identities you defend.

TL;DR: From Models to Modules—How Leaders Compose Businesses in 2025

Top firms don’t “pick a model”—they compose one: revenue logic, distribution, AI, and interfaces are modular blocks you orchestrate.

Why now: Composability accelerates launches (~80% faster), is becoming mainstream (projected 60% adoption by 2026), and boosts agility in fast-moving channels (e-commerce at 22% of retail).

Two maps, two lenses:

Executive (inside-out): Infrastructure → Distribution → Interface → Intelligence — shows where your moat (and dependencies) really are.

Customer (outside-in): Reliability/Trust → Accessibility/Reach → Usability/Delight → Relevance/Personalization — shows how modularity is felt.

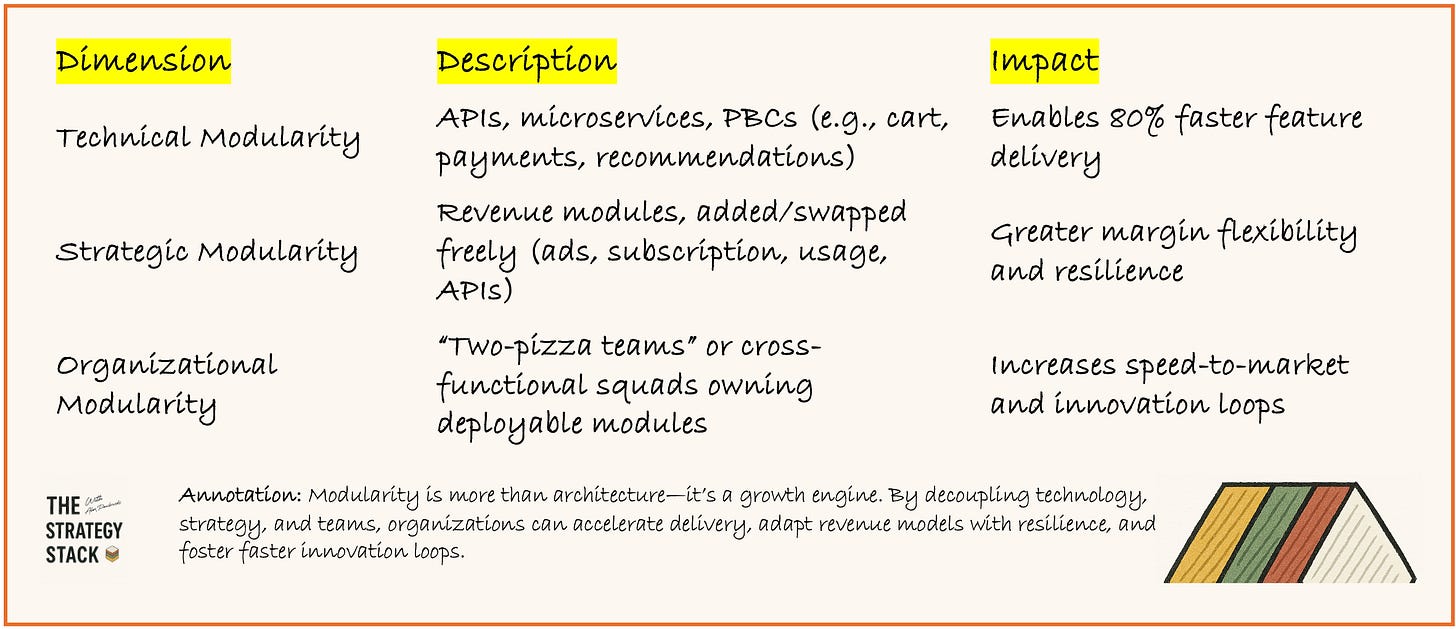

Three dimensions of modularity: Technical (APIs/microservices), Strategic (swappable monetization layers), Organizational (team-owned modules).

In practice: McDonald’s, Peloton, Spotify, Stripe, Shopify, Notion, Plaid demonstrate rapid iteration, plug-in monetization, and ecosystem leverage.

Operate like code: Orchestrate (don’t own), keep interfaces clean, layer iteratively, and recompose quarterly to remove drag.

Bottom line: The moat shifts from asset ownership to orchestration mastery—the ability to refactor your business without breaking it.

Table of Contents

Introduction: Why Modularity Now? The Composable Turn

Adoption, prevalence, e-commerce momentum, C-suite interest

From Models to Modules: A Mental Model for Leaders

Strategy lens vs. customer lens

The Model Modularity Map (Executive View)

Infrastructure → Distribution → Interface → Intelligence

Where the moat really lies (rent vs. orchestrate)

The Customer-Perspective Modularity Map

Reliability & Trust → Accessibility & Reach → Usability & Delight → Relevance & Personalization

Three Dimensions of Modularity

Technical (APIs, SDKs, microservices)

Strategic (revenue layers you can swap)

Organizational (team-owned modules)

Modularity in Action: Case Studies

McDonald’s (composable DX)

Peloton & Spotify (decoupled personalization)

Stripe (API-first monetization infra)

Startup resilience via composable stacks

Best Practices for Modular Strategy

Orchestrate > own; clean contracts; iterative layering; continual recomposition

Why This Matters: Moat, Agility, Capital Efficiency

Case Snapshots (Cheat Sheet)

McDonald’s, Peloton, Spotify, Stripe, Shopify, Notion, Plaid

Strategy Questions for the C-Suite

References

The Modular Turn in Numbers & Trends

Adoption Speed: Organizations using a composable approach launch new features 80% faster than those on monolithic platforms (Gartner, 2023).

Prevalence Projection: 60% of large enterprises will adopt composable business principles—like modular AI or API-first stacks—by 2026 (McKinsey, 2024).

E-commerce Momentum: By 2023, online sales hit 22% of global retail; composable commerce enables agility to capture this growth (eMarketer, 2023).

Practitioner Confidence: 95% of e-commerce leaders believe composability is the best long-term path (Zoovu, 2023).

C-Suite Interest: 62% of executives rank composability as a top strategic priority for agility and resilience (Alokai Survey, 2025).

👉 This perspective is strategic — it’s not a customer-facing view, but an internal mental model for leaders, strategists, and investors to understand how digital businesses are now assembled like Lego blocks.

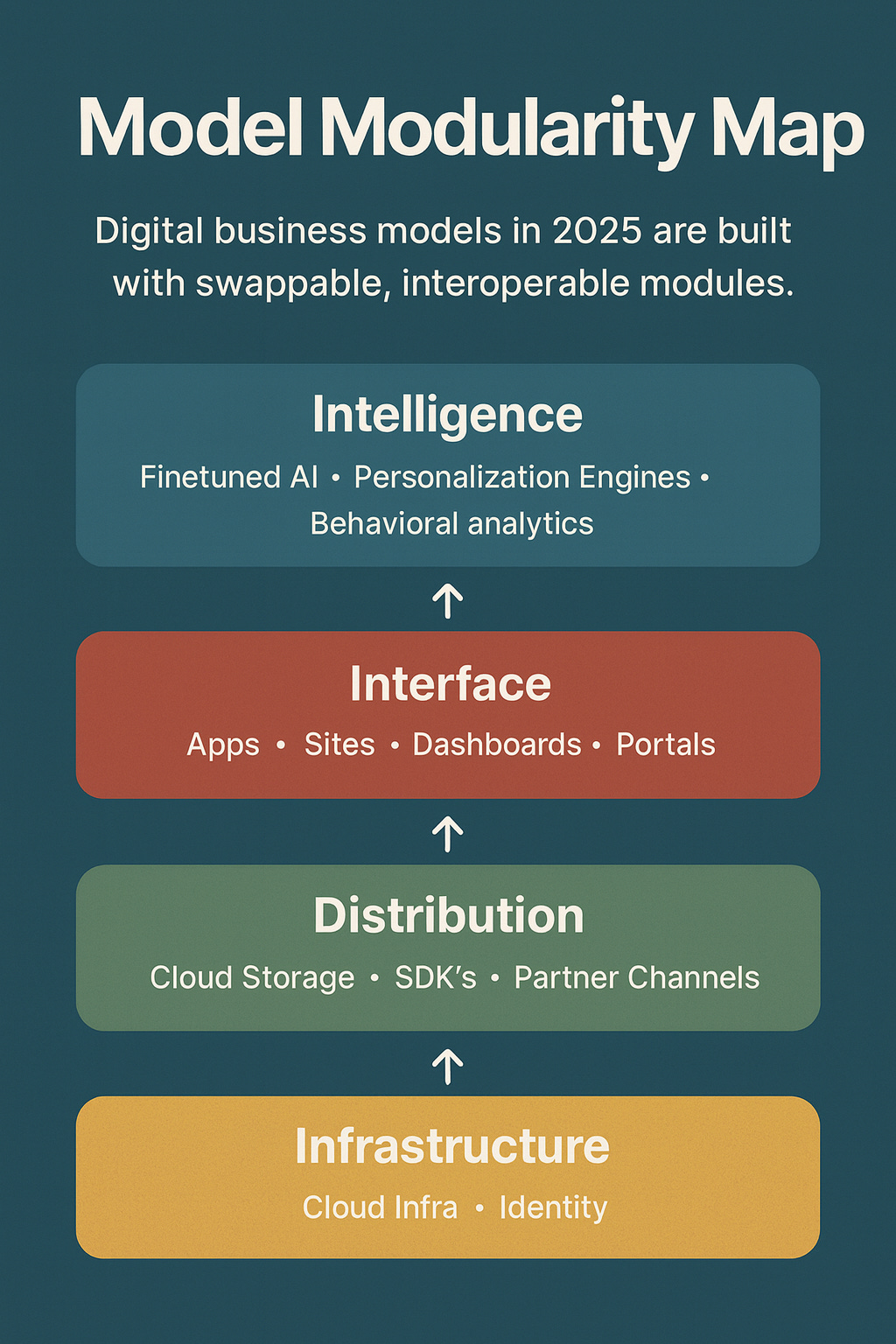

The Model Modularity Map should be read as a layered strategic framework, not a literal technology diagram. Each block represents a modular layer of a digital business model that can be swapped, recomposed, or extended:

Infrastructure → the foundation (cloud, identity, APIs) that everything else depends on.

Distribution → the channels (SDKs, partner ecosystems, app stores) that carry services outward.

Interface → the customer-facing surfaces (apps, dashboards, sites) where interaction happens.

Intelligence → the adaptive layer (AI, analytics, personalization) that makes the system learn and evolve.

The flow moves bottom to top: higher layers depend on the ones beneath but remain flexible, because modularity allows swapping without breaking the entire system.

From the executive perspective (CSOs, CEOs, boards), this map highlights where your moat truly lies: are you renting infrastructure or orchestrating distribution and intelligence in unique ways?

From the product/operations perspective, it suggests structuring teams around modules — like microservices — with clear ownership and interfaces.

From the investor/analyst perspective, it becomes a lens for assessing scalability and resilience: modular firms can pivot revenue logic and distribution faster, lowering risk.

In essence, the map reframes business design: you don’t build monolithic companies anymore — you assemble modular systems, orchestrate them well, and continuously refactor them to stay adaptive.

Modular Architecture in Action: Real-World Case Studies

McDonald’s (Composable DX for Drive-Thru & Delivery)

In under four months, McDonald’s built a new home delivery platform using a microservices architecture to support kiosks, digital menu boards, app orders, and delivery integration—a substantial achievement in enterprise-level agility.

Peloton & Spotify (Composable Backend for Personalization & Agility)

Peloton decouples functionalities—like live streaming, leaderboards, subscriptions—via independent modules, enabling feature rollouts without platform-wide downtime.

Spotify operates recommendation engines, playlists, and streaming as separate modules, letting it deploy features like podcast integration rapidly and smoothly.

Stripe (API-First Modular Monetization Infrastructure)

Stripe’s standardized API platform shows how payment processing can function as a plug-in module across thousands of platforms, enabling global scalability and rapid integration into partner stacks.

Tech Startup Resilience — via McKinsey’s Insight

Startups achieving digital transformation by layering composable elements—content management, commerce engines, and ERP systems as loosely coupled modules—can innovate rapidly, replace underperforming tools easily, and sidestep vendor lock-in.

Three Dimensions of Modularity

Technical Modularity (APIs, SDKs, Microservices)

Firms stitch together capabilities instead of reinventing them.

Example: Fintech startups launch banking services-in-a-box with Synapse, Alloy, or Unit.

Strategic Modularity (Revenue Layers)

Monetization modules can be added/swapped without re-architecting the business.

Example: Substack layering subscriptions, recommendations, and creator funding.

Organizational Modularity (Teams & Units)

Teams own deployable business modules.

Example: Amazon’s “two-pizza teams” evolve into reusable service units that powered AWS.

Keep reading with a 7-day free trial

Subscribe to The Strategy Stack to keep reading this post and get 7 days of free access to the full post archives.