What I Can’t Unsee - Bi-Weekly Digest (October 11th, 2025)

#117: 🌍 Global Moves: China’s Resource Leverage, AI’s Economic Engine, and the Platformization of Intelligence

Quick heads-up: I’ve evolved the Signal Brief into a leaner format called What I Can’t Unsee. Expect a short list of the standout signals I can’t shake, with just enough context to be useful.

China Tightens Its Grip on Strategic Resources

Beijing has expanded its export restrictions to include five new heavy rare earths and introduced licensing rules for processing equipment, effective December 1st. Officially positioned as a national-security measure, the move builds on April’s counter-tariff response to Washington and strengthens China’s upstream control of the global technology supply chain — from semiconductors to electric vehicles.

Analysts view the timing as strategic, ahead of the upcoming Trump–Xi meeting at the APEC summit. The controls will likely drive up compliance costs and lengthen production timelines for industries dependent on these minerals. The U.S., meanwhile, is boosting domestic mining and has mandated chipmakers like Nvidia and AMD to prioritize American buyers, signaling an accelerating techno-trade war.

In energy, some Russian crude exporters are again requesting Indian refiners to settle in yuan — a small but telling shift toward diversification away from the dollar, which still accounts for half of global payment value compared with the yuan’s 4%.

AI Infrastructure Powers U.S. GDP

A wave of compute-financing is reshaping U.S. investment. xAI is finalizing a roughly $20 billion capital package, with Nvidia reportedly contributing around $2 billion through a special-purpose vehicle that purchases GPUs and leases them to xAI. AMD’s parallel partnership with OpenAI adds six gigawatts of GPU capacity, partly paid through 160 million shares of AMD stock.

According to the Bureau of Economic Analysis, such investments are fueling GDP. Information-processing equipment added 1.11 percentage points to real growth in the first half of 2025, while software contributed 0.99 points — together explaining most of the 3.8% annualized expansion.

This “financialization of compute” is turning data centers into securitized assets, transforming capital expenditure into tradable instruments and embedding AI directly into the architecture of U.S. economic growth.

Google Unveils “Gemini Enterprise” for Business Clients

On October 9, 2025, Google introduced Gemini Enterprise, a new AI platform tailored for corporate users, aiming to bring its most advanced models into the workflows of business clients.

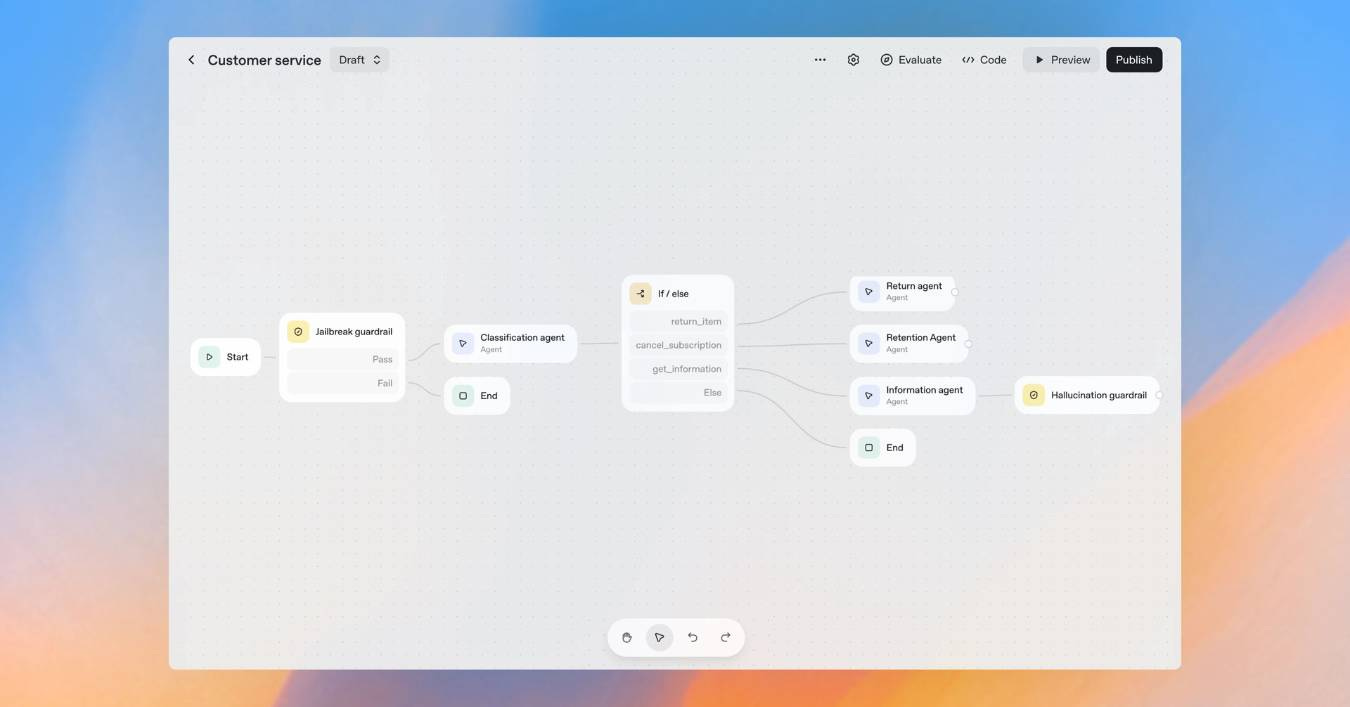

Gemini Enterprise is designed as a conversational interface where employees can interact with their organization’s data, documents, and internal applications. It provides a set of pre-built AI agents for tasks like deep research, insight generation, and data analytics, while also offering tools for enterprises to create and deploy their own customized agents.

Google has already onboarded early customers including Gap, Figma, and Klarna, and ties its offering into its existing stack (e.g. Google Workspace), positioning Gemini Enterprise as both an augment and an extension of Google’s enterprise footprint.

The move intensifies competition in the enterprise AI space, putting Gemini Enterprise in direct rivalry with platforms like OpenAI’s enterprise suites, Microsoft’s Copilot offerings, and Anthropic’s business tools. While Google brings deep experience in scalable infrastructure and enterprise sales, it must prove it can deliver both security and utility at scale.

The 2025 Nobel Laureates

Medicine: Mary E. Brunkow, Fred Ramsdell, and Shimon Sakaguchi — for discovering how regulatory T cells and the FOXP3 gene moderate immune response, unlocking new therapeutic pathways in autoimmunity and cancer.

Physics: John Clarke, Michel Devoret, and John Martinis — for demonstrating quantum behavior in macroscopic electrical circuits, forming the basis of superconducting qubits.

Chemistry: Susumu Kitagawa, Richard Robson, and Omar Yaghi — for pioneering metal-organic frameworks (MOFs), now vital for carbon capture, water extraction, and catalysis.

Peace: María Corina Machado — honored for leading Venezuela’s democratic unification and steering a nonviolent path away from militarized governance.

OpenAI’s Platform Revolution: The Acceleration of Everything

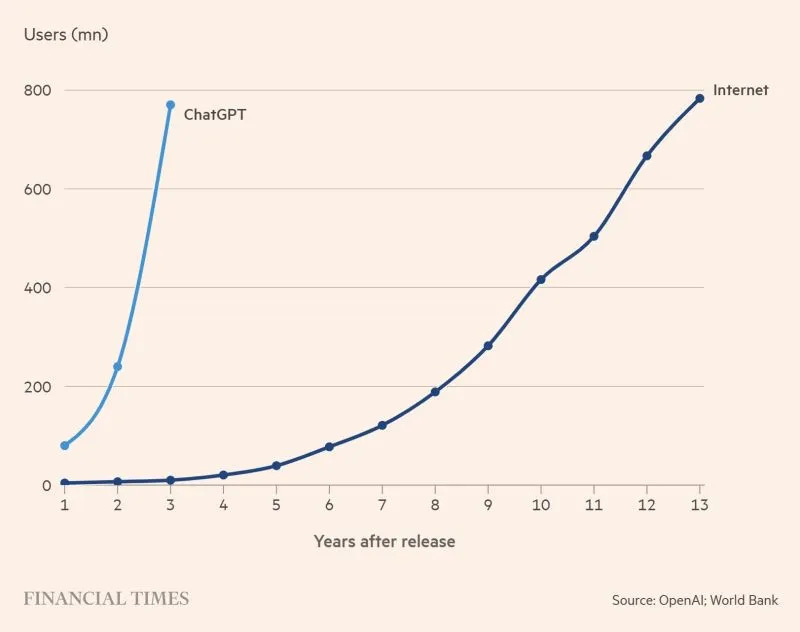

ChatGPT reached roughly 700 million users in under two years — a pace the Internet took nearly a decade to match. AI didn’t need to build infrastructure; it simply leveraged the world the web already connected.

This isn’t just growth — it’s time compression. Each AI year now resembles seven Internet years, collapsing development cycles and historical tempo alike. The consequence: exponential innovation coupled with exponential policy lag.

The App Store and AgentKit

OpenAI’s new App Store transforms ChatGPT into a living ecosystem. Developers can design, distribute, and monetize GPT-based applications within a shared conversational environment — the AI equivalent of Apple’s App Store moment.

Paired with AgentKit, a toolkit that allows GPTs to perform real-world actions via APIs, transactions, and workflows, ChatGPT is evolving from a language model into an operational platform. It doesn’t just advise; it acts.

Together, they mark OpenAI’s transition from toolmaker to platform orchestrator, setting the competitive tone for the next decade.

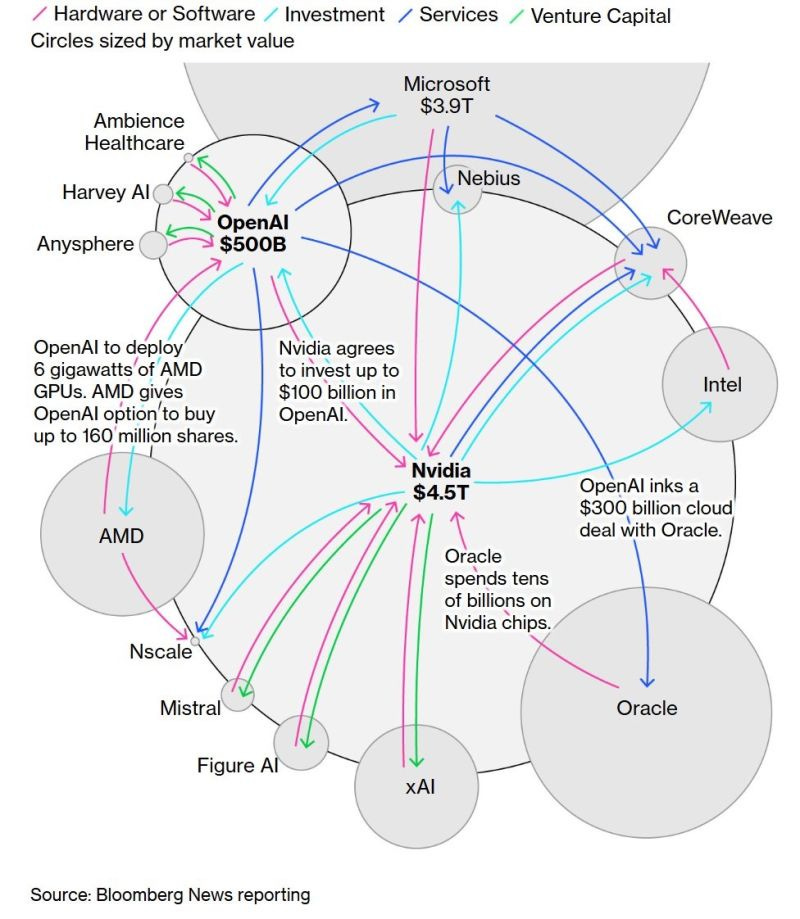

The Great AI Funding Frenzy

The current AI ecosystem resembles a capital super-network — a dense web of cross-investment, hardware supply, and cloud alliances that now rivals the Internet boom in scale and complexity.

At the center sit Nvidia and OpenAI. Bloomberg estimates Nvidia’s market value at over $4.5 trillion, with OpenAI recently passing $500 billion in private valuation. The diagram shows their interdependence: Nvidia supplies the chips that power OpenAI’s models; OpenAI, in turn, drives demand that fuels Nvidia’s market dominance. Nvidia has agreed to invest up to $100 billion back into OpenAI — effectively reinvesting its profits into the demand side of its own ecosystem.

Meanwhile, AMD is supplying six gigawatts of GPU power and offering OpenAI an option to acquire 160 million shares, intertwining supply and equity in a single structure. Oracle has committed $300 billion in cloud infrastructure to host OpenAI workloads, while spending tens of billions on Nvidia chips. Microsoft, with a $3.9 trillion market cap, remains the key strategic anchor, providing integration through Azure and software embedding.

Smaller firms — Figure AI, Mistral, Ambience Healthcare, and Harvey AI — orbit these giants, drawing venture capital and strategic partnerships at an unprecedented rate.

This isn’t just a funding cycle; it’s capital recursion — money investing in the very compute it will later consume. The boundaries between supplier, investor, and customer have collapsed into a feedback loop that amplifies valuation and velocity.

The result: an AI industry functioning as both infrastructure and market, simultaneously producing and monetizing its own demand.

Around the World

Revolut’s CEO relocates from London to the Middle East, underscoring fintech’s shifting geography.

Tether seeks fresh capital to expand tokenized gold reserves.

Russia’s heavy industries reduce hours amid export declines.

U.S. youth employment dips — fewer than half of under-30s hold full-time jobs.

AI-driven schools experiment with teacher-free adaptive curricula at $40 K per year.

The Takeaway

The Internet built the world’s nervous system.

AI is teaching it to think — faster than our institutions can adapt.

Hit subscribe to get it in your inbox. And if this spoke to you:

➡️ Forward this to a strategy peer who’s feeling the same shift. We’re building a smarter, tech-equipped strategy community—one layer at a time.

Let’s stack it up.

A. Pawlowski | The Strategy Stack

Great article Alex, thanks for curating this for us! The thing that most stands out to me is the grip on strategic resources in the global supply chain by China. Given the US' weakness in response to Russia, I worry that China might use this as an opportunity to move on Taiwan. Quite apart from the ensuing civilian disaster that will unfold, the repercussions this will have on semiconductors (I believe Taiwan produces about 90% of the world's most advanced semiconductors) is going to be wild...